Key Points / Scalping

-

Scalping is a trading style most common in forex, oil and cryptocurrency markets.

-

Scalping refers to trading which capitalizes on small price changes.

-

Positions are typically shortly after they become profitable, collecting a small profit.

-

Tools for Scalping: #tensorcharts #bitforex #phemex

Best Tools for Scalping

- Trading Platform: BitMEX

- Automation: 3commas

- Charting App: TensorCharts

Scalping Cryptocurrencies

In 2020, crypto markets are not profiled strongly towards either “long term trading” or “short term trading”. The crypto markets have a lot of both types of traders.

Often, crypto traders will resort to scalping during sideways markets situations.

Formation Scalping

Formation scalping is a trading technique that leverages the regularity of market ranges.

This is a popular technique among Wyckoffian traders. They have a good hand on recognising market ranges.

Formation scalping allows them to earn additional profit on trading the sideways phase of the market before a trend is decided.

Automated Scalping

Scalping is regarded as one of the hardest trading techniques to steadily profit from.

Short-term trading is not more difficult and does not require more skill than longer-term trading. The reason is that the fast speed of trading takes a mental toll on the trader.

There are traders who relish in scalping the fast moving market, but it does take a certain specific personality.

By all means try scalping for yourself, if you think you might be one of them.

Alternatively, you still can capitalize on these fast, small trades by using a scalping bot. The trading automation platform 3commas would be a good place to start.

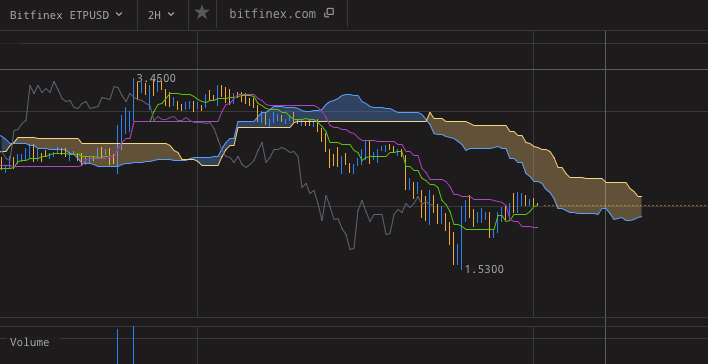

Best Charting App For Scalping Crypto

Your best tool for all short-term crypto trades are TensorCharts. TensorCharts split each candle into blocks that show the price levels at which most of the transactions took place. If you learn to work with this data, it can help you a lot with short term trading.

The information you get with TensorCharts is far more complete and granular than what you get from the standard candlesticks charts.

Read our list of tools for crypto traders for more free and freemium options.

An indepth look at Scalping is here.