The Wyckoff Method is a time-tested approach to trading the markets, especially on longer time frames.

In the crypto community, the Wyckoff method is seen as controversial because of the prevalence of chart patterns like Bart and generally the high volatility that comes with new markets for experimental assets.

Some swing traders on the large cap crypto markets do use Wyckoff method, though, and you will find the occasional Wyckoff report in communities frequented by Bitcoin traders in particular - not so much in low-cap crypto communities.

In this article:

- Wyckoff theory 101

- Basic Wyckoff cycles schema

- Full Wyckoff market cycle cheatsheet including four reaccumulation patterns

- Using Wyckoff on shorter timeframes

Wyckoff Theory of Cause and Effect

The Wyckoff theory is based on the idea that supply and demand can be determined by studying price action, volume and time. This information can then be used to anticipate future market movements by speculating on which pattern is most likely about to form, because the changes in supply and demand are the cause of the changes in price, which is the effect.

The fact that Wyckoff theory makes judgements out of patterns absolutely makes Wyckoff method a technical analysis and therefore fairly esoteric.

In place of a standard risk disclaimer, it should be noted that any technical analysis is off the table the moment somebody enters the market with a large amount of money and a determination to turn the tables. That’s why stop loss orders and risk management exist.

Analysing Wyckoff Cycles in the Market

The Wyckoff theory has its own method of five steps to evaluate when analysing markets, but only the first of them is related to market cycles. The other four judge the whole industry with respect to which niche and asset to choose to trade and which to avoid.

The one cycle-related step for analysing markets according to Wyckoff is to simply look at whether the market is trending or not.

Stands to reason - you can’t trade without knowing the market’s direction.

It’s also fairly easy to detect:

- Has the price changed consistently in a single direction over the past few candles on your timeframe? That’s a trending market on that timeframe.

- If the price didn’t go anywhere on your timeframe, that’s a sideways or ranging market.

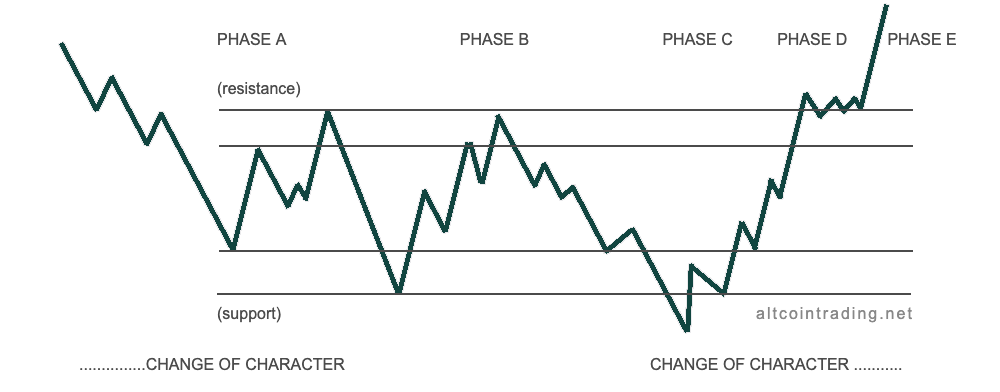

The Wyckoff cycle schematics

The crudest way to look at market cycles with Wyckoff theory then is to acknowledge that markets go periodically through periods where they are trending and through periods where they are ranging.

Wyckoff Accumulation Schematic

One of the ranging parts of the cycle is the accumulation range. Accumulation is the range that forms at the bottom of a downtrend and is characterised by increasing volume in buying.

The price is overall suppressed and majority of market participants are skeptical, which shows in the sell-offs from the top of the range.

The sign of strength is that these sell-offs from resistance are weaker with time. Typically they end in the final selloff which dips below support, but is decisively bought up. That is the Wyckoff spring.

The accumulation range ends when the resistance at the top of the range is broken on volume, with a throwback which turns it into a support.

Wyckoff Distribution Schematic

Distribution is the part of the market cycle where the market slowly tops out, most typically in three pushes.

The reason Wyckoff theory gives for this pattern effect is that entities that bought during accumulation, when the majority of the market was skeptical, are now selling to people who are buying convinced by the market’s strength.

The distribution phase is characterised by weakening rallies to the top of the range that get sold off and ultimately fail to get bought up at the bottom of the range. The counterpart to Wyckoff spring is here the Wyckoff Up-Thrust, a failed low-volume rally.

The distribution range ends when the market breaks its support completely with a throwback which turns it into a resistance - that’s a sing of weakness.

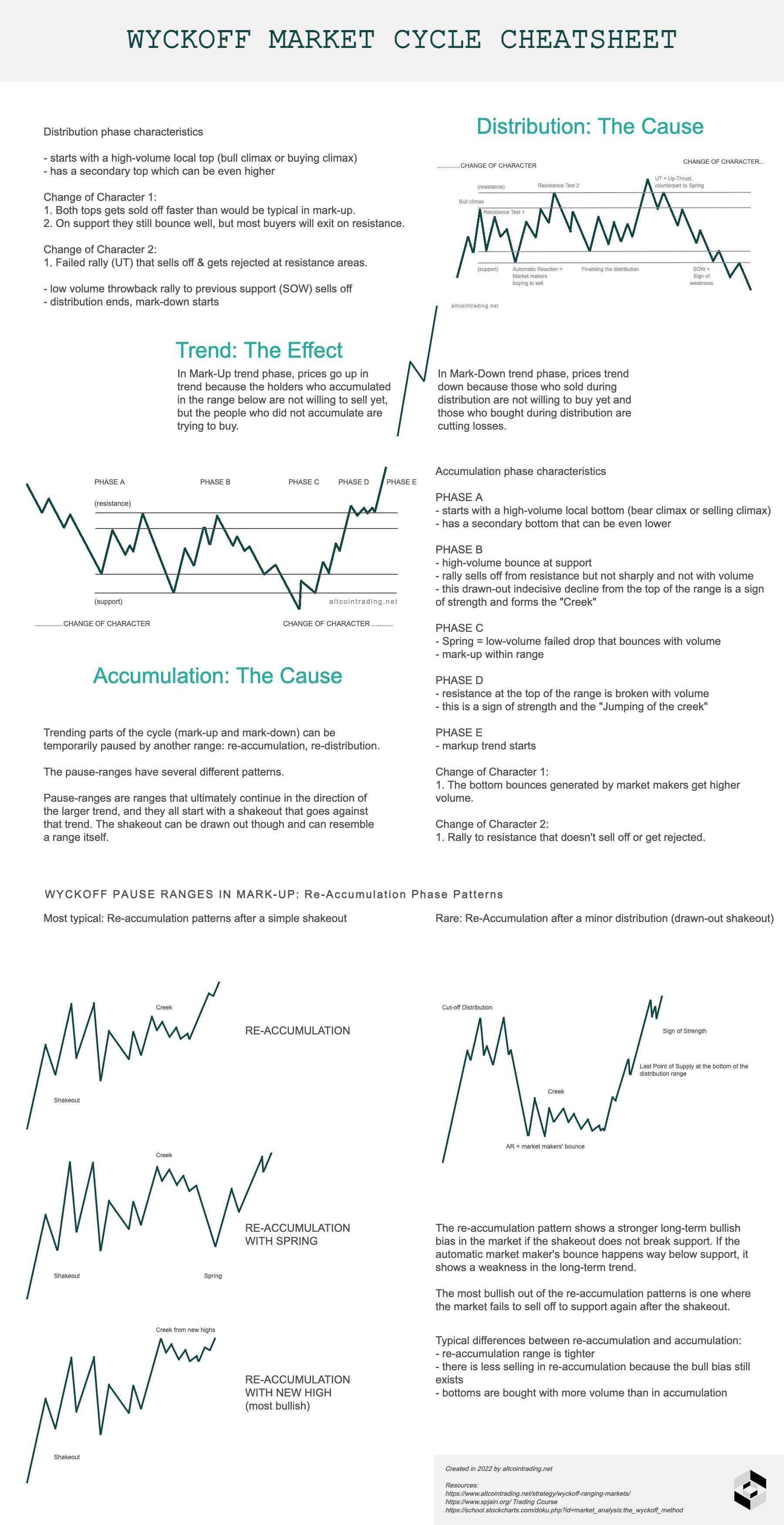

The full Wyckoff market cycle cheatsheet (Accumulation, Distribution, Reaccumulation)

The last major point to analysing market cycles with Wyckoff theory are pause-ranges.

The accumulation and distribution ranges create a cause for the emergence of the trend:

- At the end of accumulation, a critical amount of traders choose to no longer sell at the top of the range, which forces the prices up.

- At the end of distribution, a critical amount of traders choose to no longer buy at the bottom of the range, which forces the prices down.

But because the markets are not completely coordinated, we very often get pause-ranges within the trending phase. The most common pause-range is the reaccumulation, which is a range that resembles distribution but ultimately resolves into a continuation of the mark-up phase.

There are several common patterns for reaccumulations explained in the Wyckoff cheatsheet below, and one rare type of reaccumulation pattern. There’s some long-shot hopium in there, if you look for it.

Wyckoff cycles on shorter and longer timeframes

Notice that the same market can be trending on 30M but ranging on 1D. The Wyckoff theory is just a tool, there’s a degree of freedom in how to apply it, but in crypto specifically you will get more reliable results when looking at timeframes over 4H. Wyckoff theory is not built well for trading the daily volatility - the overshooting and undershooting - and on most of crypto markets, there’s a lot of that on shorter timeframes. Forex traders on the other hand do use Wyckoff theory for 30M or 1H.

As for scalping or grid trading crypto, there are tools and strategies that are a far better fit for that.

The best way you would reasonably use Wyckoff method for scalping would be to look at the overall trend of the market, comparing it with the industry, to see if there’s the potential that the market you chose will keep its sideways action.

Wyckoff theory does single out markets that are poised for a large move - and Wyckoff would advise traders to trade those. But if you are a scalper, you can use Wyckoff theory to the opposite end: Scalp or grid trade or shadow trade the markets that are not poised for a big move.

As you see, Wyckoff Market Cycle is a powerful tool that can help you answer the question of what crypto to trade, even if you are a scalper.

Final words

If you put in the time, any charting skill will give you some advantage in terms of timing your trades and maximizing your profits.

By using the Wyckoff Method, you do get an edge over other traders who are guessing about the market’s next move without looking at the bigger picture, the industry, the economy. It can provide a way to see through other traders’ interests and it can show you how they’re preparing for future moves. You would need to spend a lot of time analysing the markets and also trading, though. Practical skills can’t be read up.