Technique

beyondta

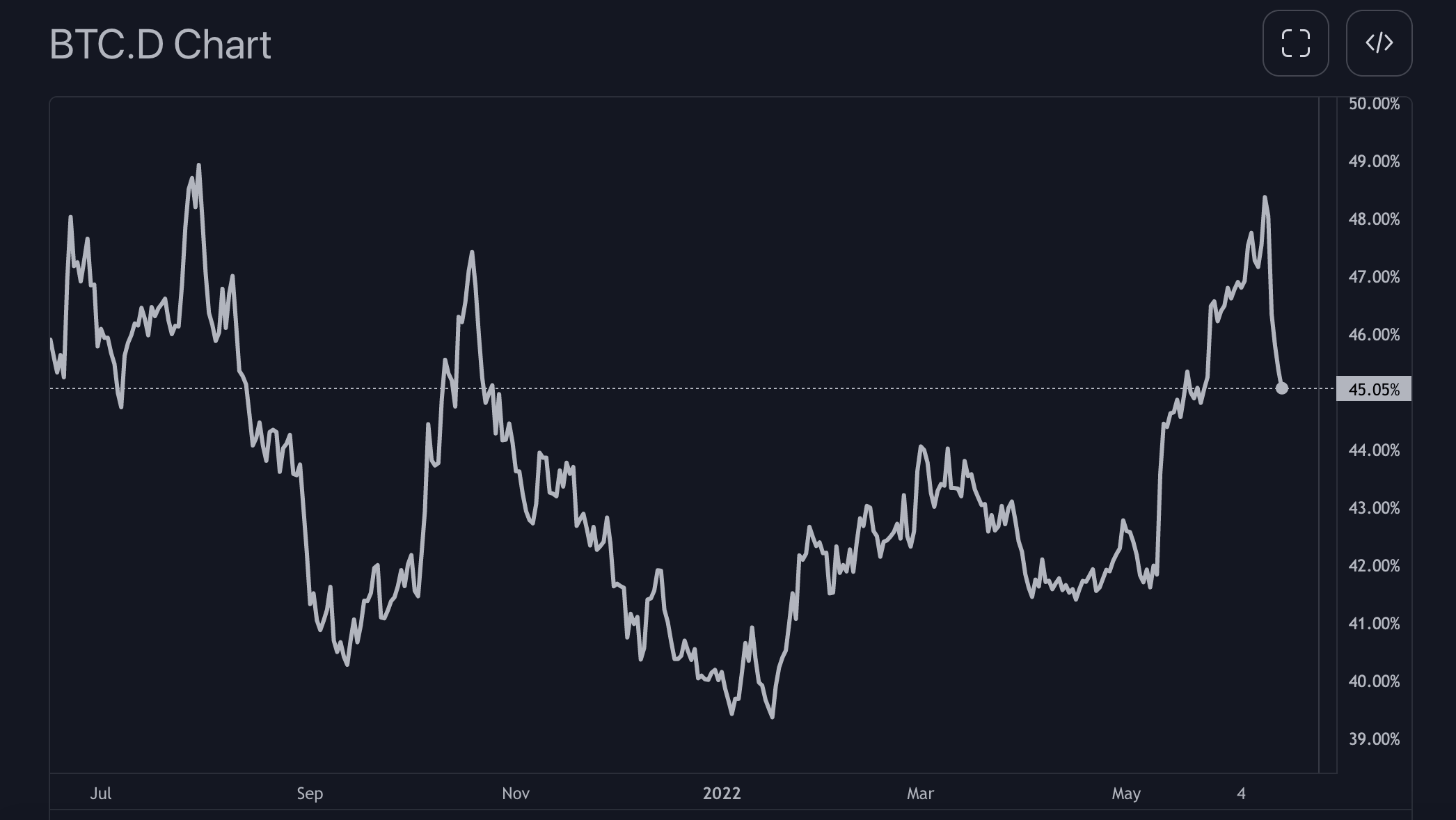

Crypto Market Psychology

What is the definition of crypto market psychology and how is it formed?

What is the definition of crypto market psychology and how is it formed?

technical

Engulfing

What is bullish engulfing and bearish engulfing? Are cryptocurrencies good markets to trade on engulfing?

What is bullish engulfing and bearish engulfing? Are cryptocurrencies good markets to trade on engulfing?

method

Pattern Trading (Formation Trading)

What is pattern trading and what are the best performing formation patterns to watch for in crypto.

What is pattern trading and what are the best performing formation patterns to watch for in crypto.

Charting

technical

BBands

What are BBands, why are they loved so much by crypto traders and what are their highest probability patterns on the crypto markets.

What are BBands, why are they loved so much by crypto traders and what are their highest probability patterns on the crypto markets.

technical

Div

Div, AKA Divergence. Covers regular div, hidden div and exaggerated divergence with links to more info on how to trade them.

Div, AKA Divergence. Covers regular div, hidden div and exaggerated divergence with links to more info on how to trade them.

technical

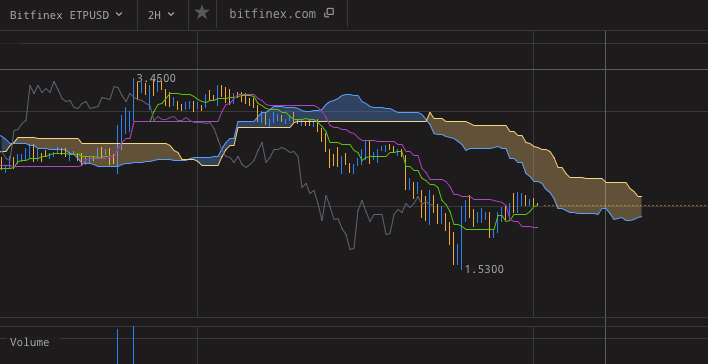

KC (Keltner Channels & BB/KC Squeeze)

What are Keltner Channels, what is the difference from Bollinger bands and how to use them in crypto.

What are Keltner Channels, what is the difference from Bollinger bands and how to use them in crypto.

technical

Sideways Market

What is a sideways market, also known as ranging market, and how to trade it.

What is a sideways market, also known as ranging market, and how to trade it.

DeFi

Crypto OPSEC

OG Crypto Opsec

Electrum

All you need to know about the Electrum wallet, plus links to all the guides (how to install, signatures, backups, sweeping, segwit and legacy addresses)

All you need to know about the Electrum wallet, plus links to all the guides (how to install, signatures, backups, sweeping, segwit and legacy addresses)

Crypto Jargon

jargon

Risk-Reward Ratio (RRR)

What do crypto traders call RRR and how to use it in your risk management?

What do crypto traders call RRR and how to use it in your risk management?

jargon

Value Averaging

What do crypto traders call value averaging and how is it different from DCA, or cost averaging?

What do crypto traders call value averaging and how is it different from DCA, or cost averaging?