Until DeFi came around, our only way to generate income from crypto holdings was either active trading or margin lending to other traders.

DeFi and PoS changed that…Kind of.

Neither yield farming nor staking are super groundbreakingly new concepts.

-

…is just a way of providing liquidity to traders.

As a yield farmer, you depend on active trading of your token.

… is just a way of automated lending to the whole network.

As a staker, you get rewarded for confirming transactions, you depend on the blockchain being active.

In this blog we’ll focus on yield farming in 2025.

Now that so many services around cold staking and yield farming developed, it is quite easy for everyone to earn some extra income from their crypto.

That also means that the actual yields got much lower, because the market is now more saturated. In line with that, we outline a way to stay up do date with the latest markets to snatch early opportunities.

Best Yield Farming Platforms

To start off, here’s a list of some of the currently popular yield farming platforms. And a little explanation of how to navigate the space to maximize your yields.

OG yield farming platforms and more successful clones

-

Chains: Ethereum, Polygon, Optimism, Arbitrum

In v3 there have been a lot of changes to the yield farming protocol. Read how to provide liquidity using the new Advanced functions.

-

Chains: Ethereum, Polygon, AAVE

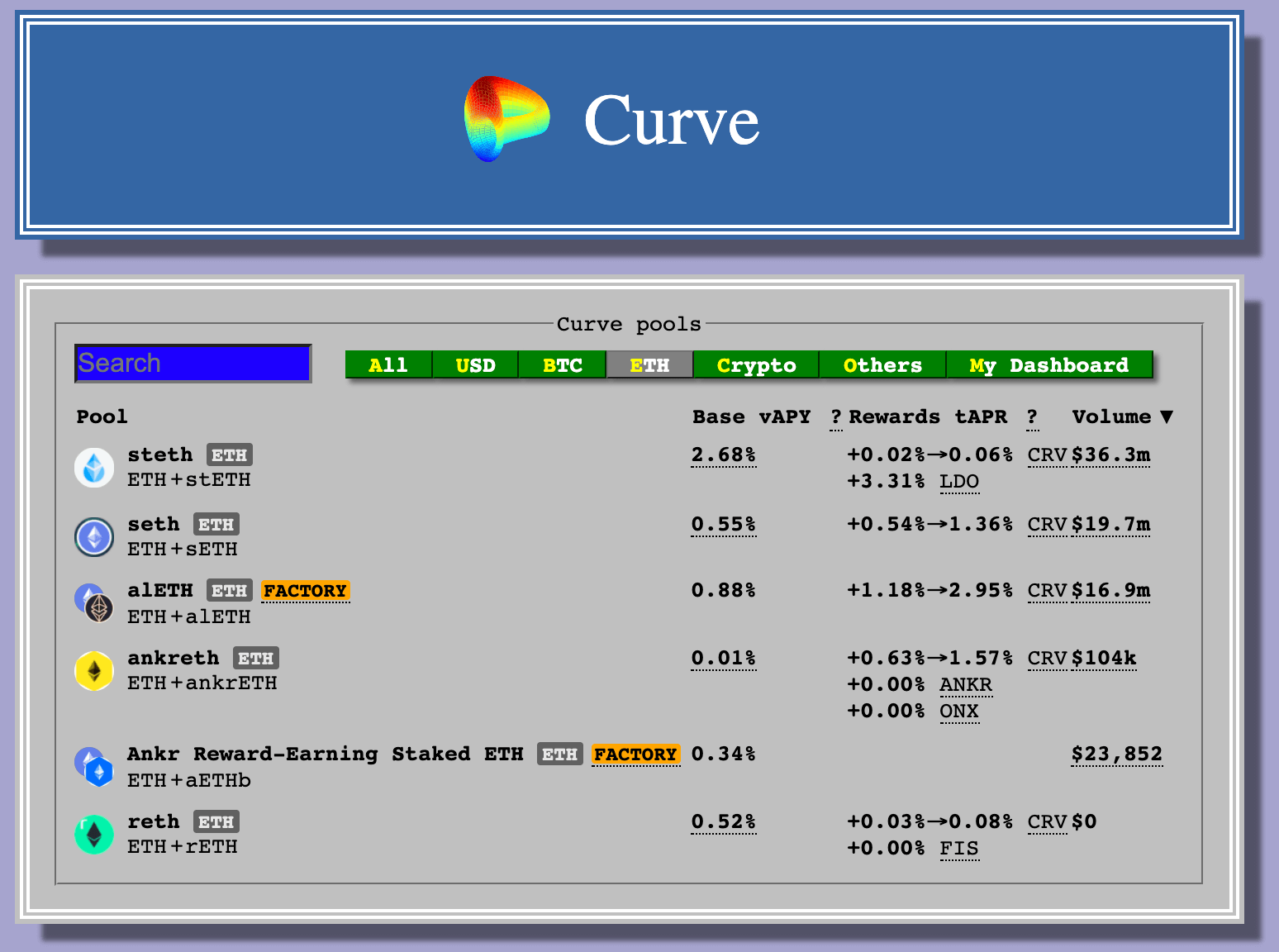

The Curve is a DAO that launched on ETH in August 2020. Curve allows liquidity providers to take decisions on adding new pools, changing pool parameters, adding CRV incentives and other aspects of the Curve protocol.

Chains: Ethereum, Binance Smart Chain, Polygon, Optimism, Arbitrum

1inch is an aggregator of large amount of DeFi markets, either on ETH or on BSC or some of the newly added blockchains. Only launched in summer 2021, it got quite a traction and v2 is in the works.

-

Chains: Ethereum, Binance Smart Chain, Polygon, Optimism, Arbitrum and many others

SushiSwap supports the largest number of different blockchains to use to trade and yield from tokens.

In addition to yield farming, Sushi Swap now offers classic lending without automated-market-maker, which means no impermanent loss. Some of the rates are interesting.

-

Chains: Binance Smart Chain

PancakeSwap did not add support to other chains, it’s still only BSC. It did add NFT trading though, which keeps people interested.

Smaller clones

- CoinSwap BSC

- PooCoin BSC, MATIC, KCC

- BakerySwap BSC (focused on NFTs)

Why Yield Farming paid so much (in the beginning)

Yield farming is the new DeFi type of lending where alt-coiners have been generating crazy returns until midway through the year 2020 or so.

Let’s explain in broad strokes how it earning yields works.

- In yield farming, you lend your money to a trading platform with automated market-making (AMM) system.

- DeFi trading platforms rely on their liquidity being crowd-sourced like this.

- Because of that reliance they will pay a lot to get their liquidity in. Without it, there could be no trading.

- The demand side: The more popular the platform gets, the more liquidity it demands, the more you can earn from providing it.

- The supply side: The more people start providing coins to generate yields, the higher the supply of the coin, which decreased yields as the demand is met.

Yield Farming Got Crowded

Clearly, if you want to keep earning as much as you can from your farming, you need to keep track of two things:

- which DeFi platforms people currently trade on.

- which coins that have some hype around them are getting newly listed there.

Your opportunity is on any platform where traders want to trade and where there is not enough liquidity to meet that demand.

So far, it’s still not one-and-done. The top platform is the one that (still, despite regulations) has the highest volume - Binance. Token traders are opportunistic and move between platforms quite a lot, though.

Why DeFi traders move platforms a lot

Why will an alt coin trader switch exchanges? Usually it’s one of the two following reasons:

- The fees are too high and they want to move from ETH to the Binance Smart Chain (BSC) or some other novel chain.

- The shitcoin of the week is not yet listed on their old exchange and they want to trade it.

If you are a DeFi liquidity provider, you will need to know where the traders flock and follow them.

On decentralized exchanges, you don’t even need to make an account. You simply plug in a wallet like Metamask and trade directly from it. That’s one thing that makes it so easy to switch between DEX platforms.

Once a trader stops liking their DeFi exchange, they might do a quick skim through Reddit to see where else people are trading, and go plug your wallet to the new place.

Yield Farming Strategy for 2022

If you want to know about new DeFi markets to provide liquidity to, go to the same places where traders go.

-

Shill exchanges where coins get shill

Here’s a couple of forums where shills post about the latest DEXes, alt coins and NFTs:

Alternatively, you need to make sure they hear about the exchange you work on and get curious. That is why there are so many DeFi shills everywhere these days.

-

Look for clones of current yield farming platforms

New decentralized and DeFi swaps crop up all the time. They are almost never written from scratch. In almost all cases, they are a clone of a different DeFi swap.

So, you can get ahead if you go to GitHub and search for Uniswap clone, Sushiswap clone, Yearn finance clone…Anyone can make their own clone and try to get the traders in.

Here is a list of the more OG places traders still talk about a lot. You can use them as a starting point for your searches:

DEX Chain What draws the traders in Uniswap ETH, MATIC… Advanced functions in liquidity provision Curve.Finance Ethereum Low fees and minimum slippage SushiSwap Ethereum Network effect at this point -

Look for yield farming platforms with rising volume

Two words: Dune Analytics.

NFT traders will find the data valuable, too.

Bottom Line

Maybe one day the DeFi market will mature and vast majority of people will have the same go-to DEX for yield farming. But for now, your yield will change wildly from platform to platform.