Cold Staking Crypto - Updates for September 2022

Welcome to the September 2022 update of the staking wallets guide. This is where we are keeping eye on the time-tested, reliable, independent crypto wallets for cold staking of Proof-of-Stake cryptocurrencies. We also mention the three top crypto exchanges that will let you stake through their wallets or locked staking programs, though always for a hefty fee.

Ledger in September 2022 launched a new offer for the ETH Merge. Since 15 Sep, ETH holders can buy a bundle of Ledger Nano X and Billfodl at an additional 20% off. The deal is a special 20% off coupon that gets unlocked via an ETH address that you have to own. Ledger says they process the address but do not store it.

Billfodl is the US-based manufacturer of stainless steel metal storage for wallet seed phrase. Other than when sold via ledger.com, Billfodls ship from the US so this bundle might also save you duty charges if you are outside of US.

The list of staking coins supported by Ledger is available at Ledger’s website here.

Exodus wallet in September 2022 released a couple of updates. The Web3 version of Exodus, which in non-buzz speak is known as the Chrome extension, added the support of Algorand. All ALGO tokens are supported. Also, Exodus made it easy to use the Web3 wallet to access DeFi protocols like Algofi, trade and mint NFTs on AlgoSeas, use the Tinyman token swap, or participate in Governance. Other than ALGO, the Web3 version of Exodus supports ETH and SOL, with all their tokens.

The desktop Exodus app wallet released its 22.9.8 version in mid September with new features not directly related to staking. They added support for customizable pet Aavegotchis and full support for the following tokens: SYN (ETH), STG (ETH), GMX (AVAX), and GHST (Polygon).

Cold staking rates on Exodus app wallet increased a tiny bit for Solana but generally keep stable, as on the linked screenshot.

For staking of low-cap coins in September 2022, your best option are still staking pools, at least if you want to avoid the 20% service fee that centralised exchanges take. Jump to list of pool guides for niche alt coins like KAVA.

Some low-cap staking coins can be staked at better rates in “launch pool” promo events on centralized exchanges. Launch pools are time limited staking events for new coins, exchanges use these events to test the popularity of these alts.

Out of KYC exchanges, Binance.com runs them and so does CEX.io occasionally. For no-KYC version of the same product go to Phemex.

Phemex specifically runs an earn promo almost every week, as is always reported in our exchange promo feed.

As a note, launch pool staking is a black box, your money is at a higher risk than in cold staking.

Enjoy!

In the rest of the article we cover:

- What is cold staking and what are the risks

- Best Staking Wallets

- Staking on Exodus wallet

- Staking on Trezor wallet

- Staking on Ledger wallet

- A few comments on KYC’d staking wallets like Trustwallet that blocked some of y’all due to geopolitics

- Best Exchanges to stake crypto

- Staking on Bitfinex

- Staking on Binance

- Staking on FTX

- We cover dedicated staking platforms for big holders in a separate post

What is staking crypto?

Crypto staking is a way to earn income by holding a certain kind of cryptocurrencies in your own crypto wallet, or on a crypto exchange that supports staking yield.

This guide is for cryptocurrency wallets for cold staking, or network staking. Only cryptocurrencies running on an algorithm called PoS, or proof-of-stake, are can yield this kind of staking income. In these blockchains, staking is the mechanism that replaces mining in securing the ledger and verifying new transactions.

- Best cold staking currencies in 2022 are SOL, ADA, XTZ or TRX out of the big ones, and then any number of low-cap cryptocurrencies including some of the big name dog money like SHIB.

As a note: The DeFi community sometimes uses the term staking for liquidity provision. DeFi staking is a different activity and is done from different platforms - more here.

What are the risks of staking crypto?

Staking income is not risk-free, but typically the risk of cold staking is lower when compared to trading crypto as well as when compared to DeFi staking (yield from liquidity provision).

As long as you use an unhosted staking wallet like Ledger or Exodus instead of staking from an exchange, you still fully own your coins, because you own the private keys to your wallet. Staked coins only get delegated for staking. Delegated funds cannot be lost or stolen.

Some of the security and financial risks you can run into when staking crypto:

- Bad validator: You stake a coin via delegating to a validator, and the validator decides to not pay you. (This is rare)

- Wallet breach: Your staking wallet or exchange account gets hacked. (Rare if you take precautions)

- Volatility: A fundamental event changes the valuation of your PoS crypto and you will not be able to sell it, due to having coins locked up in staking. (Yeah this happens)

If you decide to stake via a custodial exchange like Binance, you will need to deposit your alt coins to that exchange and the exchange will stake them for you.

This exposes you to the additional risk of loss through a security breach: Somebody can hack your account or the exchange as a whole.

So, the least risky staking coins are those that offer high yield and are available for staking from un-hosted wallets (Ledger, Trezor, Exodus…). If you want to really make it super low risk, the staking coin should pay staking yield directly from the network, so that there is no need for validators, but practically this is a bit of an overkill.

- Staking coins that pay out directly: Komodo, NEO.

- Staking coins that you need to delegate to a validator node: ETH2, Tron, Tezos, Polkadot.

Staking crypto from a crypto wallet

Desktop wallet apps that offer staking have the best combination of benefits. It is easy to stake crypto through a wallet, the risks are lower than when staking on an exchange, and the yield it gives is higher than when staking on an exchange.

It is not technically demanding to start staking from a crypto wallet. Right now, the yields are typically higher than what you get from margin lending.

Market inefficiencies happen, but this is the rule: You will not get 0.015% daily rate consistently to make those 5% p.a in margin lending these days. But 5% APY is just about the typical rate for cold staking of big-ish coins in a bull market.

And then, staking rates will typically be better in a wallet than in staking through exchanges, because exchanges do charge fees. To give you an idea, Coinbase charges a whopping 25% fee on your staking reward as per their ToS. The other popular staking exchanges - Binance, Bitfinex, FTX - do not disclose their staking fee, they only state they charge some fee.

Best Wallets for Staking

The most popular staking wallet globally is still the Binance-owned Trust Wallet. The popularity of Trust Wallet is given by the fact that it’s one of the few places that let you stake BNB coins.

But since Trust Wallet is owned by Binance, and Binance bans certain geo-locations, you may not be able to trade or stake certain cryptocurrencies. And that is exactly the reson why AltcoinTrading.NET always advocates smaller, independent wallets.

- If you’re one of those who got “BNB not available” in Trust Wallet, then you need to start trading and staking BNB without Binance. (It’s possible!)

Here’s the top of the market among independent crypto staking wallets:

Staking on Exodus Wallet

Crypto staking rates fluctuate. Exodus staking yields shown above were retrieved on Sep 15, 2022.

Staking cryptos supported by Exodus: Solana SOL, Tezos XTZ, Cardano ADA, Algorand ALGO, Cosmos ATOM, Ontology ONT, VeChain VEC / VeThor VTHO. Exodus does not support BNB staking.

Exodus is the most popular free and independent crypto wallet app. It supports over 100 currencies and is available for Android, iPhone and as a desktop app. Exodus wallet staking is available on all of these versions of the wallet.

The focus of Exodus wallets is on sleek user interface that makes high-tech functions accessible to everyone. For instance, this is all you need to click to stake ALGO from your Exodus mobile app:

Is Exodus trustworthy?

Oh yes. Exodus has been around for a long time. They earn fees from the instant exchange that comes with Exodus wallets and that keeps them independent from industry behemoths.

They are known as pioneers and integrate new features very quickly. For instance, they rolled out a graphic NFT gallery for the Solana blockchain recently.

You cannot do anything too technically advanced with Exodus, such as signing a message with an address. But it is the best choice for you if you are a regular crypto holder who just wants to cold-stake crypto with great rates, good security and minimum hassle.

How to stake crypto on Exodus

- Install the Exodus wallet for desktop from

exodus.comor get the mobile app from your app store. - Click the “+” symbol in the top navigation (on the right). This will take you to the list of wallet apps to install.

- Select the app called “Rewards” and install it.

- Click the newly added “Rewards” button in the top navigation bar.

- Rewards app lists out all the current staking rates, recalculated as yearly.

- Choose the coin that yu want to stake and click “Start earning”

- The detail page will have all the detailed information on what the minimum balance is, whether you need to claim the reward and if there is any fee.

- If you do not have any balance of that staking coin, Exodus lets you exchange it directly in your wallet for any crypto that you own. Or you can log into your FTX account directly from Exodus and buy some there with lower fee.

Here is the official full walkthrough for how to start staking ADA in Exodus wallet:

A couple of notes for new Exodus wallet users:

- Exodus wallet is free, because it is only a software. You need to run it from a phone or a laptop…

- …So, always make sure your crypto staking computer is clean and malware-free.

- If you stake, trade and accept crypto payments, split your Exodus wallet into portfolios - one for each purpose. Here’s how to do it - it’s really easy.

Staking on Ledger Wallet

Crypto staking is enabled in the Ledger Live app for any Ledger wallet model - Ledger Nano S, Ledger Nano X and the new Ledger Nano S Plus.

Staking cryptocurrencies supported by Ledger:

- Ethereum (ETH2),

- Polkadot (DOT),

- EOS (EOS),

- Tezos (XTZ),

- Cardano (ADA),

- Tron (TRX),

- Neo (NEO),

- Cronos (CRO),

- Nem (XEM),

- Cosmos (ATOM),

- Terra (LUNA),

- Internet Computer (ICP),

- Elrond (EGLD),

- Algorand (ALGO).

Which Ledger wallet model should you get? If you are going to get a Ledger wallet for staking of more than one cryptocurrency, get either the Ledger Nano X or the new Ledger Nano S Plus. These two models enough more capacity to run multiple wallet apps at the same time.

Is Ledger a good wallet for staking?

Yeah, Ledger is a good choice of wallet for staking for a small holder. It is easy to use staking pools if your coins are on Ledger and it is easy to stake directly from your wallet as well.

But Ledger is also good for large holders because it’s easy to run your own validator from a Ledger wallet: Everyone in the crypto staking business will always provide setup guides for the Ledger wallet, just because it is so damn popular.

And then the whole security aspect. Ledger’s security is better than that of a software wallet. Ledger is not as super top tier as Coldcard, but it runs on a secure element chip and the wallet is isolated from whatever malware may exist on your computer.

Ledger Live also now comes with a crypto exchange on board. If you don’t yet have the crypto you want to stake, you can buy it there.

How to start staking on Ledger

There are different ways to generate revenue directly in Ledger by staking. What actions you need to take depends on the coin you want to stake, but most of the staking coins currently supported on Ledger will want you to delegate the coin to a validator.

On the other hand, staking is available by default in Ledger - you don’t need to install any special staking app within Ledger Live or elsewhere.

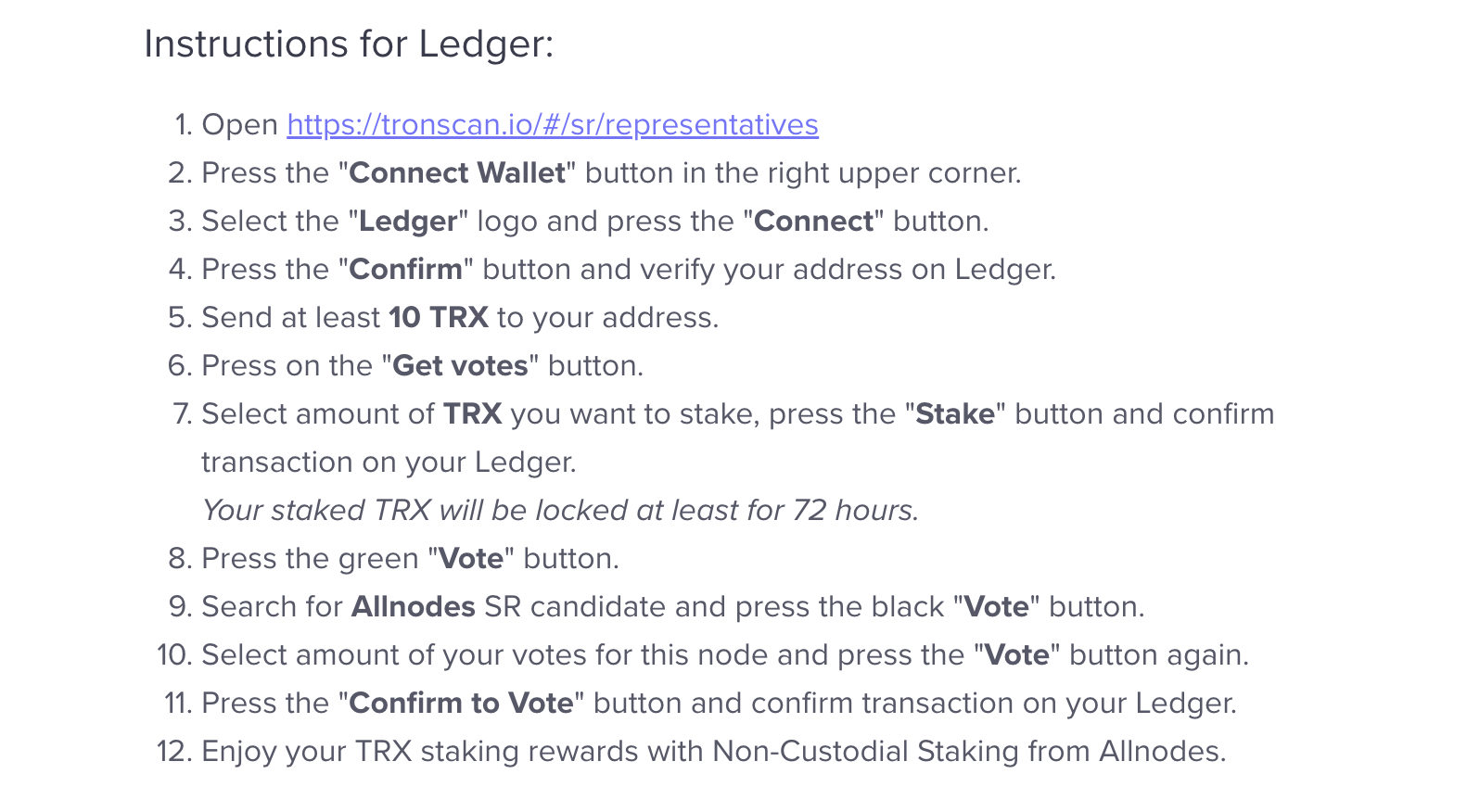

Here is the official full walkthrough for how to start staking TRX in Ledger wallet:

Links to other staking tutorials available from Ledger:

- How to stake SOL on Ledger

- How to stake XTZ on Ledger

- How to stake ATOM on Ledger

- How to stake ALGO on Ledger

- How to stake DOT on Ledger

Can you stake from Ledger even if Ledger does not directly support staking of that coin?

Most other PoS cryptocurrencies that are supported in Ledger wallets can be staked through a third party wallet, or through a staking pool.

Often you will need to stake through a wallet specific to that staking coin, but you will be able to authenticate in it via your Ledger wallet. Then it’s just delegating your coin to the staking pool, which is basically two clicks.

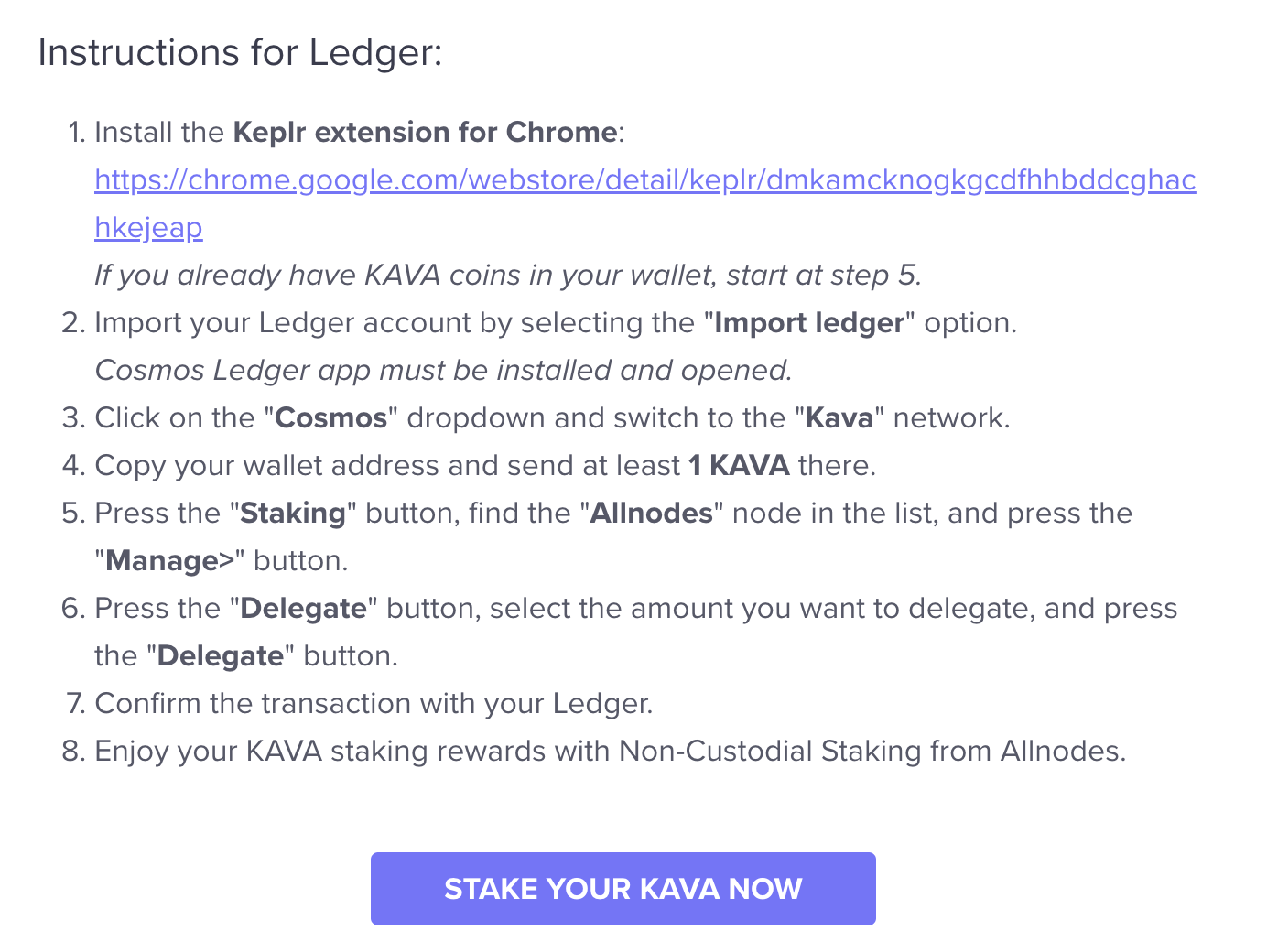

For example, here is how to stake KAVA coin in the AllNodes staking pool from your Ledger wallet. Ledger does not support KAVA staking directly, but you can authenticate with your hardware wallet into the Keplr extension that you need to stake KAVA.

You can also choose to use staking pools for coins that Ledger does support directly. For illustration, here’s how to stake TRX (Tron) from Ledger wallet via AllNodes:

Here are some of the coins that can be staked from Ledger through AllNodes. They all can be stored on Ledger, but not staked directly:

- Stake MATIC from Ledger just by clicking “Connect” and connecting your Ledger wallet.

- Stake XRD via Radix wallet from Ledger

- Stake KAVA from Ledger via Keplr browser extension

- Stake Osmosis (OSMO) from Ledger via Keplr browser extension

- Stake Persistence (XPRT) from Ledger via Keplr browser extension

- Fantom (FTM) can be staked from Ledger via MetaMask

Staking on Trezor wallet

Any model of Trezor wallet supports delegating coins to any staking pool or validator. Additionally, you can start staking your Trezor coins via Exodus as Trezor wallets can also use Exodus wallet as their user interface.

If you want to make use of the Exodus staking pool without holding your private key in the Exodus app, link your Trezor device to Exodus. It’s much safer that way, and you are still getting those sweet Exodus staking yields. (Jump to the section on staking at Exodus)

Which Trezor model should you choose? That’s really up to you. The Trezor T has some impressive tech inside, but for your Average Staker Joe that makes little difference. Trezor One is much cheaper and does the job too.

Trezor is the second most sold crypto wallet. You can be sure that staking pools and validator hosts will always provide an easy step-by-step guide on how to delegate coins into them. Setting up pooled or dedicated staking from Trezor will not take a minute on most pools.

ADA Staking via delegation from Trezor T:

This is what stake key registration looks like for ADA on Trezor T:

Plugging a Trezor wallet into a staking pool:

Here is what ADA Trezor staking set up looks like at AllNodes:

AllNodes supports easy Trezor staking of Polygon (MATIC), Cardano (ADA), Polkadot (DOT), Huobi Eco Chain, ETH2, The Graph (GRT), NEM and more. The platform also has one-click apps to set up masternodes and validators using all common alt coins via Trezor wallets.

Easiest way to stake crypto: Staking on Exchanges

Several custodial exchanges let you earn yield on PoS altcoins just by holding them on the platform. Be careful: Staking on exchanges is custodial, you send coins away from your privately owned wallet.

On Binance, bitfinex, Bitforex and most other platforms you need to transfer coins into a staking area on the exchange in order to stake them.

Bitfinex stakes your coins automatically, as long as you keep them in the exchange wallet.

Other staking policies differ from one exchange to another as well:

- Binance does not let you retrieve staked coins unless you chose flexible staking from the beginning. Rates are variable, it’s difficult to make it into the pool as they are limited.

- Bitfinex only does flexible staking (soft-staking), your coins are never locked. You can move and trade your crypto at any time. But you’re getting a sh1t rate.

- FTX locks your coins but lets you unstake them either within a set period for free or instantly for an extra fee. Rates are often high.

- Kine DEX is a new DEX that is run by ex-Huobi people. Kine made it to this list because it lets you stake BNB without KYC.

It is not a good practice to hold crypto on an exchange. On the other hand, exchange wallet staking may realistically yield around 6% APY which may look acceptable for taking the risk that your exchange will get hacked.

However, in Exodus or at AllNodes pool you might be getting 10% or 19% APY, so consider it well.

Most popular staking pools on AllNodes:

- Terra Luna staking pool 0% commisson

- ADA staking pool 0% commisson

- SOL staking pool 0% commisson

- ETH2 Rocket Pool - NEW! 16 ETH minipool

How to stake crypto on Bitfinex

Bitfinex automatically pays staking yields for the following currencies: TRX, EOS, Tezos, Cosmos (ATOM), Algorand, Cardano, Polkadot, Ethereum 2

Bitfinex calls their way of staking a soft-staking program. You do not need to take any action, just deposit the supported coin into your exchange wallet on Bitfinex and leave it there.

Bitfinex will not lock up your funds for a certain period of time, you don’t need to delegate them either. You will simply get weekly income.

How does soft-staking on Bitfinex work?

In soft-staking, you don’t delegate coins and there is no lock. You can withdraw (or trade or lend) your coins at any moment.

In order to allow for the flexibility in platform withdrawals, soft-staking system on Bitfinex stakes only a portion of the total user pool of wallet deposits. If they did it otherwise, there wouldn’t be enough available coins available to withdraw out of the platform. And that, coupled with the fee of undisclosed size that Bitfinex takes from your staking yields, is also why the yield on Bitfinex is lower.

Another implication of the Bitfinex staking system is that while there is no minimum deposit to stake, you only get a payout if its value is over 0.5USD by the time rewards distribute every week. If your yield is lower, you lose that week’s payout to the house (who always wins /jk).

Should there be an “exchange run” and too many people would want to withdraw their PoS coins, Bitfinex says they would delay withdrawals until enough coins would be available after the staking period’s end.

This is the reason why you might sometimes get an error notice on staking exchanges like Bitfinex and Binance, nagging you that there is “not enough exchange balance available” when you try to move your coins.

It’s pretty much the analog of fractional reserves in banks, except crypto is staked with low risk and fiat is put into bonds and other legacy low-risk investments.

Go to staking.bitfinex.com

Staking on Binance: Is it worth the hassle?

Binance offers a set of yield generating products - staking, DeFi, locked savings and liquidity provision.

The platform groups together DeFi liquidity providion and cold staking, calling the first “flexible staking” and the latter “fixed staking”. Out of the two, fixed staking is the actual PoS staking where you provide coins to secure the blockchain. The flexible staking is what is otherwise known as DeFi staking - lending into the market for a yield. Binance calls it flexible because it does not lock your funds for a set period.

Coins supported for cold staking on Binance: Oh, many. Fixed staking (cold staking) on Binance has limited availability. You do not always get to stake even if you own the right coin and hold it on the exchange.

In contrast to Bitfinex, on Binance you need to actively manage your holdings to get any staking income. That is certainly a drawback for crypto investors who have better things to spend their time on. On top of it, fixed staking does not let you move them until your lock is over. Additionally, the maximum yields on large-cap cryptos are way lower than even on Bitfinex.

On the other hand, Binance provides staking and DeFi yield generation for many of the low-cap staking cryptocurrencies. The supply there is smaller and so the staking yields do shoot up to 40% or more for these smaller staking alts. Also, the minimum amount you can stake on Binance is very low - usually 1 unit of the cryptocurrency. For cheaper coins like ADA that makes the barrier to starting to stake very low.

- TLDR - Don’t use Binance to stake big crypto, but do use it to stake low-cap staking cryptocurrencies.

Staking on FTX: Smaller selection but better rates

On FTX, you can choose to stake several cryptocurrencies for a fixed period. It is a true network staking with high yields, especially high for an exchange.

The system is quite well designed. You lock your coins and start generating income, to retrieve them you make an “unstake” order. Your staked coins will be retrieved after a grace period (~ 14 days) or instantly for an extra fee.

FTX usually gives annualized staking returns between 10-20%, but the selection of coins to stake is smaller. The selection changes quite a bit over time.

- As of May 2022, FTX Staking is only open for FTT, SOL, SRM and RAY.

Best place to stake large amounts of crypto: Dedicated staking platforms

Staking platforms run a network of nodes and pools into which small hodlers can chip in by delegating their coins from any common wallet. We have reviewed dedicated staking platforms in another post - go on here.

Large holders, or holders able to pool users, will benefit more from running their own validator node. With big providers you can spin up a validator as a one-click app and start staking pretty much in minutes, without having to download and deploy the full node yourself.

-

Large holders: Masternode Hosting or Validator Node Hosting

Most providers let you deploy masternodes and validator nodes in minutes. There are automated or semi-automated setups for Ledger, Trezor and the usual single-coin wallets for that particular altcoin.

There is a monthly hosting cost and sometimes other fees. On Allnodes, the monthly fee starts at only 5 USD though.

Each coin has a (high) minimum of coins that you need to have to run a masternode or a validator. For masternodes and validators the upfront investment is significant, but your netto monthly income will typically be somewhere between 500-2000 USD.

-

Smaller holders: Non-custodial Staking Pools

Small holders pool by delegating money from their wallets and provide additional liquidity to validators.

Some pools charge a flat fee for participation, some take a cut of the profits, but generally you will get better deals than from staking on exchanges. That’s especially for staking large-cap cryptos like ADA or ETH2.

To set up your participation, you just need to delegate coins from any wallet you’re using to the pool under its contract ID. You’ll get the exact instruction in your provider. It’s not complicated:

Most popular staking pools on AllNodes:

- Terra Luna staking pool 0% commisson

- ADA staking pool 0% commisson

- SOL staking pool 0% commisson

- ETH2 Rocket Pool - 16 ETH minipool

Summary

There is a growing number of ways to yield staking income by securing PoS networks.

If you are not a technical person, you can choose the Exodus wallet or Bitfinex and Binance exchange to pretty much just deposit and forget.

If you are a larger holder, running your own validator will give you more revenue. The tech overhead there is lower now thanks to staking providers that automate a good part of the process.