What is P2P arbitrage?

P2P arbitrage is a trading strategy that is quite specific to cryptocurrencies.

In P2P (peer-to-peer) arbitrage, traders generate profit on the fact that there are P2P marketplaces to buy and sell cryptocurrency privately, with no intermediary and often without getting personally identified.

For the convenience of skipping the onboarding into a crypto exchange, the P2P seller is allowed to charge a markup over the public market value.

In this strategy article we will go into the nitty gritty of the P2P arbitrage strategy, including a lot of practical info.

Let’s start with the basics of P2P arbitrage and then go through some public data to see how much a real vendor makes per year.

Contents:

- P2P Arbitrage 101

- How much it earns and what kind of money you need to start

- Your risks and how to lower them

- What currencies trade P2P and can be arbed

The basic setup for P2P arbitrage:

P2P arbitrage trader buys a cryptocurrency on a low fee CEX exchange and sells it with a markup on a P2P marketplace.

P2P marketplaces track price action of cryptocurrencies they support, so your markup is given as a percentage over the live rate - such as “5% over Kraken”.

In P2P arbitrage strategy, the seller re-buys all crypto sold P2P immediately on a low fee CEX exchange for the current market rate.

The markup charged over the exchange rate minus all your fees makes the arbitrage profit.

Pulling off the above setup practically requires you to keep money on all of the platforms involved: The low fee CEX exchange, the P2P market, your bank.

- Some of your crypto must be always deposited in your P2P account, otherwise people will not be able to initiate a buy from you.

- Your CEX exchange account must always have about your expected daily traded volume in fiat, so that you can immediately buy back any crypto that gets sold via your P2P account.

Once someone initiates a buy from you on the P2P platform, you give them your payment details and ask for a confirmation of payment. As soon as they send it, you buy the same amount on your CEX.

Once the buyer’s payment clears and arrives into your account, you release the crypto to the buyer. Then you transfer the re-bought cryptocurrency from your CEX to your P2P account and you deposit the fiat into your CEX.

What kind of profits you can expect from P2P arb

How much you can earn from P2P arbitrage in crypto? Let’s look at a real vendor.

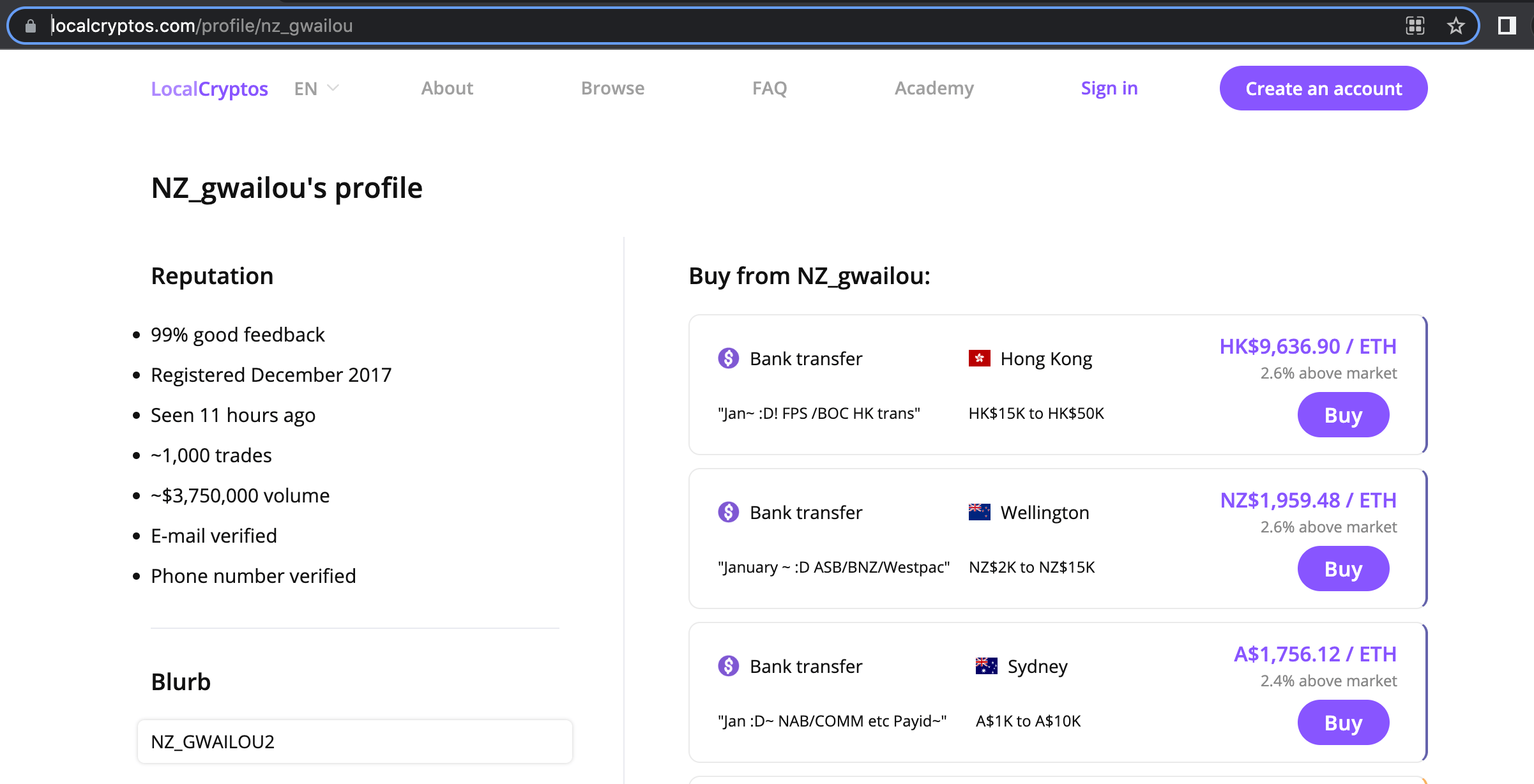

This is an active vendor on LocalCryptos, one of the P2P markets for big cryptos.

This vendor trades in Hong Kong, Australia and New Zealand and has been active for about a year. He offers ETH with the markup of 2.6% above market price or BTC at 3%. The method of payment is national bank transfer - the least risky one.

The 3% markup is reasonable for the payment method, it would be much higher for apps like Paypal.

The total traded volume he made in his one year long activity is 3.75 MM USD. If he traded 5 days a week, this puts his daily traded volume at slightly below 16k USD.

He is a fairly active trader who makes between 3-4 trades a day on average.

When you look at the numbers it’s clear he might have started with only some 50k USD worth of capital that he moves around quickly.

How much did he manage to make on his 3% markup?

-

Low fee CEX options

The first thing to consider in P2P arbitrage is your cost to buy crypto. As a P2P vendor, you are looking to buy from an exchange that has low market order fees (that is the fee for an instant buy) and that supports deposits in your fiat currency.

This trader sells for HKD, so let’s assume that he is a citizen of Hong Kong and banks there.

Out of Hong Kong, the vendor is allowed to buy crypto for HKD from Binance.com, FTX.com or OKX. I assume the vendor was starting with fresh exchange accounts without discounts for traded volume but with a discount for referral code, if it’s available.

Here’s the comparison.

Exchange Initial market order fee Referral discount Fee Deposit type Bank costs to deposit Binance.com 0.10% 10% 0.0900% Instant card payment or local deposit in HKD 0 FTX.com 0.07% 5% 0.0665% International wire 50 HKD (6.4 USD) OKX 0.10% 0% 0.1000% Instant card payment or local deposit in HKD 0 FTX has the lowest trading fees but to wire HKD there you need to do an international wire transfer, which has a cost.

Binance supports HKD deposits via local bank transfer or instant credit card deposit, which means you wouldn’t have to keep your money on the exchange.

Binance also lets you gain further fee rebates for holding BNB fairly easily and often releases flat fee discounts for everyone. On the other hand, crypto trades at a slightly higher rates on Binance when compared to FTX.

Overall I’d say it’s still more convenient to choose the exchange with a fast local deposit, which is Binance in this case.

-

Costs of for your P2P sales

This vendor trades on LocalCryptos which is a decentralized application with a built-in escrow. The app is built in a zero-knowledge way which means that it has managed to resist any rulings about platform-wide KYC, but private KYC from the side of the vendor is encouraged.

Buyers don’t mind complying with that. The LocalCryptos platform has no access even to the files exchanged in private communication between the buyer and vendor.

The platform is also non-custodial. You need to deposit your crypto into an exchange wallet so that it can participate in the escrow on the platform, but you get your 12 word seed phrase for your P2P wallet.

The ultra secure setup of LocalCryptos lowers the risks of the vendor getting scammed (without any top down regulation, by the way). That allows vendors to charge lower markups; this vendor does charge a relatively low markup of 3%.

He will probably ask for a picture of your ID and will refuse to trade if the name on the transfer won’t match that of your ID. He can afford that because the APAC region is one of the most popular ones on LocalCryptos.

LocalCryptos charge escrow fees of 0.25% if you post an offer, so this together with the transaction fee for the release adds to the vendors expense.

-

Putting it all together

Assuming the trader chose Binance with a basic 10% discount and pays nothing for his bank account, which is possible with some of the new digital-only banks in Hong Kong, he earned about 96k USD in his year of activity. He made ~2.6% - not of his initial investment, but of his traded volume.

Considering he might have started with about 50k USD, he effectively dOuBlEd hIs BiTcOiN without risking any money on speculation or without locking it into sketchy interest yielding schemes.

Yearly Monthly Daily * Traded volume $ 3,750,000 $ 312,500 $ 15,625 Markup earned (3%) $ 112,500 $ 9,375 $ 469 EXPENSES: Binance fees (0.09%) $ 3,375 $ 281 $ 14 Escrow fees (0.25%) $ 9,375 $ 781 $ 39 Bank fees (0%) $ - $ - $ - BTC tx fees (avg 2 USD) ** $ 2,500 $ 208 $ 10 PROFIT: $ 96,875 $ 8,104 $ 405 * Assuming 20 working days per month ** Assuming 5 transactions per day, 5 days a week, 50 weeks per year I ran the same with numbers for OKX and FTX, both exchanges gave a slightly lower profit, about 1k USD less yearly.

If you have more capital, you could possibly optimise your process by parking some of your money into stablecoins. Both USDC and USDT are accepted for fast deposit on FTX.com, along with several other stablecoins.

You could buy your stablecoin for fiat deposited locally for zero banking free and then make use of the lower fees on FTX.com by re-buying on their Tether markets.

Stablecoins do introduce some additional risk though, and the extra profit made from it would be only about 1k USD yearly over the Binance setup.

Obligatory shill links:

- FTX 5% fee off - use code

altcointradingon FTX.com oraltcointradingUSon FTX.us - Binance.com 10% fee off with shill link

- LocalCryptos sign up or read our review

- FTX 5% fee off - use code

The risks of P2P arbitrage (and how to limit them)

Your risks in this strategy are not trading risks.

P2P arbitrage is true arbitrage: You are buying and selling the same asset at the same time, which means that you are not exposed to losses from price volatility.

All your risks in P2P arbitrage are counter-party risks:

- Your P2P buyer can scam you. For instance, they can pay you via PayPal and ask for a refund when you release the crypto.

- Your CEX can fold or get hacked.

- Not all P2P marketplaces are non-custodial. If you trade on a custodial P2P market where you don’t have the private keys of your P2P wallet, then the funds on that P2P can be lost just like on a CEX.

To lower your risks, the most important thing is to use an escrow. Escrow will lock the crypto out of your or the buyer’s reach until you release it after you make sure that the fiat payment arrived.

Escrow is available on all big P2P markets - LocalMonero, LocalBitcoins, LocalCryptos, Binance P2P.

You generally won’t get escrow in private deals over Telegram or message boards. Just in case you need to hear it from someone, people absolutely can scam you even if they’ve been trading with you for months prior, it happens all the time.

Getting scammed by your buyer is by far the largest risk you face. Other than that it’s just security breach on your exchange or on your account. You can lower your CEX risks by not holding money on there and choosing a CEX with instant deposit option for your currency. Or you can use stablecoins, if you are feeling brave.

List of cryptocurrencies you can trade P2P

The largest crypto P2P marketplaces are the following:

- LocalCryptos trades Bitcoin, Ethereum, Dash, Litecoin and Bitcoin Cash

- Paxful trades Bitcoin, Tether and Ethereum and requires AML/KYC for some regions

- LocalMonero trades Monero

Two more large P2P marketplaces are the following, who require a centralized platform-wide KYC:

- Binance P2P requires KYC and trades Bitcoin, Tether, BUSD, Binance Coin, Doge and DAI

- LocalBitcoins requires KYC and trades Bitcoin

Final notes

In P2P arbitrage, you earn money on a small markup that you circle around as fast as ever you can.

The way to earn in this trading strategy is not necessarily by having a ton of capital (even though that helps) but moving it around quickly. You will not be able to pull that off in many locations around the world because the demand just isn’t there. I suggest you browse P2P marketplaces yourself and see if you are in a good geolocation to sell P2P.

A lot of the practical side depends on where you are, but if you want to do volumes in P2P, you will probably have to set up a company for that. In general you should not need a license for this type of activity unless you do it as an asset management service with other people’s money, but YMMV.

Lastly, the latest rounds of EU regulations makes it look like there might be regulations imposed on P2P vendors. The law is only set to come to effect in 2024, so there’s still plenty time to make money. But under it, P2P vendors would probably be required to store the buyers’ ID.

That’s the five dollar wrench attack equivalent as applicable to zero-knowledge dApps: Even if the platform is zero-knowledge, the vendor can always screenshot what buyers send to them.