Key Points / ALMA

-

ALMA is short for the Arnaud Legoux Moving Average

-

ALMA gives better signal to noise ratio than SMA or EMA

-

ALMA is great for scalping (bot or manual) as short-term support/resistance

-

Tools for ALMA: #cryptowatch #tradingview

What is Arnaud Legoux Moving Average (ALMA)

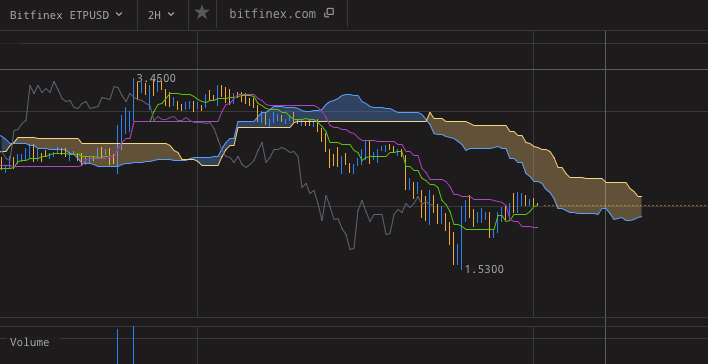

In trading jargon, ALMA means Arnaud Legoux Moving Average. ALMA is a charting tool popular among stock and crypto traders.

ALMA is a moving average that reduces the noise of small price fluctuations by averaging the price from both directions - from past to present and the other way too.

In mathematical terms, it uses the shape of a normalized distribution (kind of like the bell curve).

What that does in practice is it lessens the time lag that all moving averages have, due to being averaged over lengthy time periods.

How to trade ALMA

-

Use it as the faster MA. The ALMA indicator lags less, which means it can be used as the faster MA for your crossovers. This is a strategy that can be easily automated and with proper settings will give better results than using plain moving averages.

-

As a confirmation of oscillators. The ALMA can also confirm overbought or oversold conditions signalled by oscillators like StochRSI or Inverse Fisher RSI. As the ALMA always sticks close to the price, you can confirm your levels just by seeing if it’s above the price or below. In an overbought market with ALMA over the price, you’ve got a sell signal.

-

Use it for scalping. I pity anyone who wants to do this manually but in sideways markets you can scalp the crossovers of ALMA with price.

Best Tools for TA Trading in Crypto

- Trading Platform: Bitfinex

- Charting Tool: Tradingview

- Trading Bot: Shrimpy

Read our list of tools for crypto traders for more free and freemium options.