Key Points / Crab Market 🦀

-

Crab is choppy sideways market

-

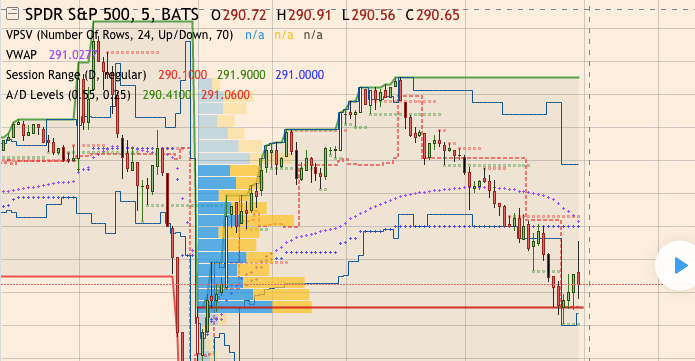

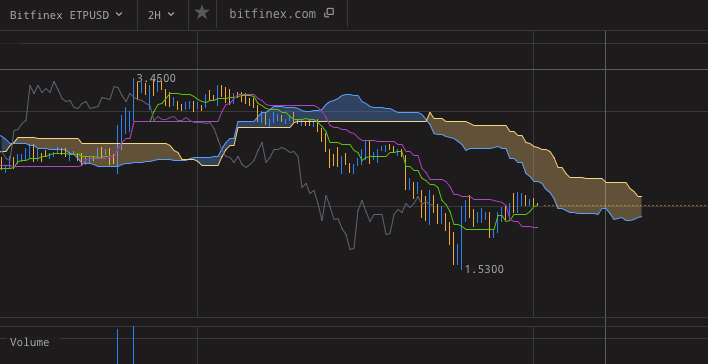

Tools for Crab Market 🦀: #tradingview

In trading jargon, crab market stands for choppy sideways market, market that lacks direction and is not trending.

What is the best way to make use of a crab market?

If you are an active trader and want to keep trading, the best strategy would be a short term one. A short term strategy like scalping is the best choice because the market isn’t trending anyway.

One advantage of short term trading is that you can easily automate it.

Best Tools for Crab Markets

- Trading Platform: Set up a scalping bot at Coinrule

- Technical Analysis: Wyckoff, Support/Resistance, Boxes

- Charting App: Tradingview

Crab market vs Bear market

Crypto traders distinguish between the crab market and the bear market.

The crab is taken to be milder, without drastic capitulations. Just a long stretch of crypto prices being suppressed, all local highs sold.

- Bear market (in a crypto trader’s view) starts with a fall from the blow-off top and then drags on for 4 years.

- Crab market is an anticlimax, months and months of meh.

Trading Techniques for Ranging Markets

One of the old but still well fitting descriptions of a typical ranging market can be found in the Wyckoff method. The Wyckoff method is focused on longer term trades and the crux of the range trading is the identification of the phase in which the market is.

A market can be ranging because there is an accumulation or reacummulation going on, after which a bull trend follows.

Alternatively, a market can be ranging because there is a distribution starting, after which a bear trend follows.

An indepth look at Crab Market 🦀 is here.