Key Points / Risk-Reward Ratio (RRR)

-

RRR is short for risk-reward ratio

-

It is about balancing not getting stopped out too much vs not risking too much

-

Tools for Risk-Reward Ratio (RRR): #shrimpy #tradingview

In trading, risk-reward ratios (RRR) are used to determine how much you’re risking in relation to the amount you potentially stand to gain.

Traders work with risk-reward rations every time they set a stop loss.

Charting tools like TradingView make it possible to mark your RRR on their charts when you’re planning or sharing your trades.

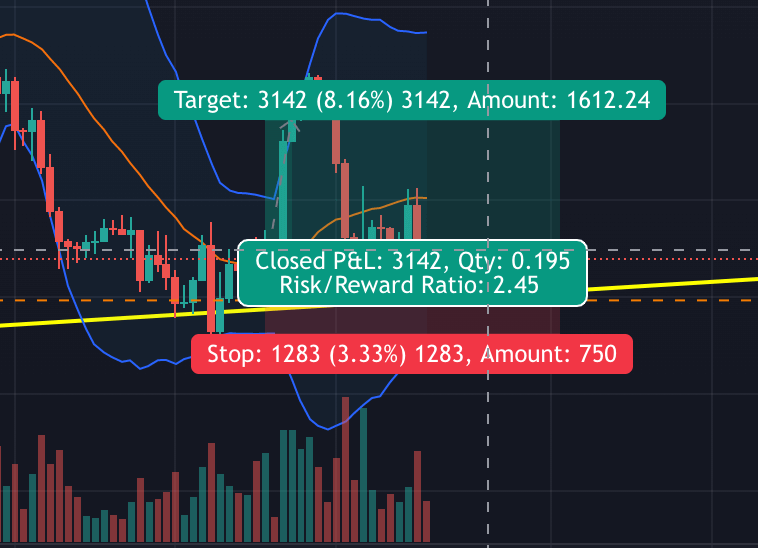

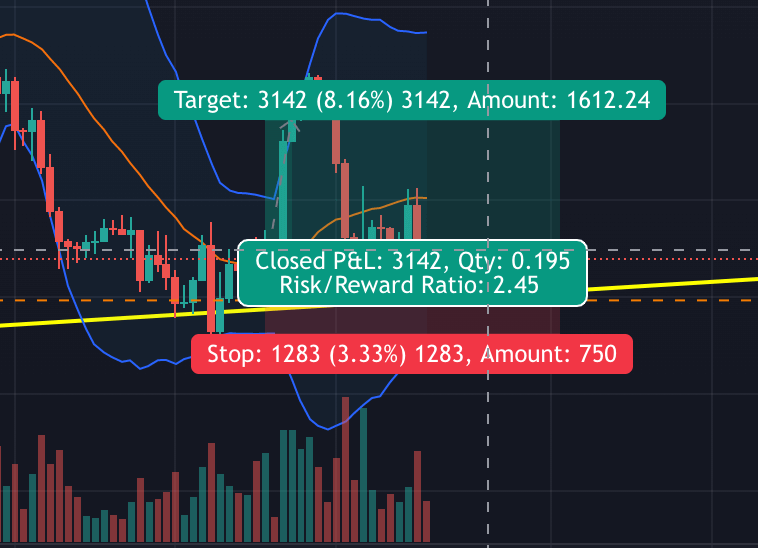

This is what a risk-reward ratio long trade looks like on TradingView:

|

|

Common risk-reward ratios

The 1:x risk-reward format

Using the most intuitive format, a trader may be willing to take on a trade with a 1:3 risk-reward ratio, which means that for every $1 they stand to lose, they could potentially make $3.

In a 1:2 RRR, you are risking 1 dollar to every 2 you might gain.

Both these are considered a long-term profitable risk-reward ratio, as the potential reward is greater than the potential loss.

Conversely, a trader may be willing to take on a trade with a 1:1 risk-reward ratio, which means that for every $1 they stand to lose, they could potentially make $1.

This is considered an unfavorable risk-reward ratio, as the potential loss is greater than the potential gain.

TradingView RRR format

Tradingview reports your risk-reward ratio in the simplified format - only giving the reward part. It is the convention to always have the risk part as 1, which means you might as well leave it out and traders will still understand.

So, a risk-reward ratio given as 3 is the same as 1:3

In the screenshot above you see a risk-reward ratio of 2.45, or 1:2.45, for a long on BTCUSD.

- You are placing your stop loss to risk a 3.33% loss for a chance at your target 8.16% profit.

- 8.16% profit from open is a 3142 USD difference. 1283, or 3.33%, makes the price difference from open to stop loss.

- Dividing 8.16/3.33 gives 2.45.

- Dividing 3142/1283 also gives 2.45.

The RRR of 2.45 is a “favourable” risk-reward setup because it puts less money at risk than it projects to gain.

Stop-hunting in crypto markets

The reality is (sadly) not that simple.

A 2.45 risk-reward ratio on the super volatile crypto markets will results in your trades getting stopped out more often. There is a thing that is sometimes referred to as “stop hunting” where large traders are able to temporarily move the market just enough to trigger everyone’s stops.

So at the end of the day, if you get stopped out of your otherwise well-judged speculations, then that stop loss is not that favourable at all.

If you trade manually and babysit your trades, in volatile markets it may be a good idea to set a loose stop loss at first. Then watch the price action and move your stop into profit as soon as you can.

Automated trading

On the other hand, risk-reward ratios are priceless in bot trading - in crypto or elsewhere.

In automated trading, you are not present to babysit your position. Also, usually your trading bot is programmed to make many small trades a day - more than you would manually.

This makes bot trading a numbers game. You need to have a defined risk to stay profitable in the long run. So, there is not much of a successful bot trading without considering risk-reward ratios.

Portfolio-wide Risk Management

Last but not least, if you hold multiple cryptos, you might be interested in portfolio-wide risk-reward setups. It’s the exact same thing as what you do on a single market, except you define how much base value you are willing to lose in a drawdown on your total portfolio.

It is possible to automate your portfolio management with tools like Shrimpy, which offers a portfolio-wide stop loss.

An indepth look at Risk-Reward Ratio (RRR) is here.