In this strategy, we’ll explain what is DCA and why you probably want to do that instead of hodl, if you are bullish on a cryptoasset.

In the second part of this strategy we’ll list the best exchanges that let you automate your DCA for free as well as commercial DCA bots.

If you want to jump around, here’s the table of contents:

- The basics of DCA strategy

- Why DCA beats HODL:

- Buy and hold profit estimate in 10 years

- Projected DCA profits modelled as cycles of parabolic runs and crashes

- Best exchanges for DCA, manual or automated

- Automated DCA:

- On exchanges: FTX, Pionex, Independent Reserve

- As standalone DCA bots: Coinrule, Bitsgap

Dollar Cost Averaging Definition

What is DCA? In crypto or otherwise, DCA stands for dollar cost averaging, which is a trading technique that removes any short-term price speculation from your investing.

Dollar cost averaging, or DCA, means to invest a set amount of money into an asset in regular intervals, disregarding the price action.

It is key to understand that dollar cost averaging only removes the short-term price speculation. If you want to DCA, you need to be long-term bullish and expect that the asset you are buying will appreciate in time - otherwise, DCA-ing into it would make no sense.

Dollar Cost Averaging Strategy in Cryptocurrencies

You can dollar cost average into absolutely any investment asset just by purchasing some amount of it regularly - say, every week or every month.

A monthly DCA into Bitcoin can look like this:

- You decide to put 500 USD into Bitcoin monthly.

- Every month on the day your salary arrives, you deposit 500 USD into a crypto exchange.

- Once the deposit is credited, you log onto the exchange and immediately buy 500 USD worth of Bitcoin, come hell or high water.

Or, you know, you can automate it.

The main point is to buy your DCA share of Bitcoin on the same day every month, regardless of the price action at that time.

Why DCA beats HODL

If your goal is most of all to get more crypto, then in the long run, doing DCA with skull-splitting regularity beats simple buy and hold.

The reason is that with DCA, you are putting additional money into your position in that asset. It may not seem like that but when you do the math, the additions add up over a few years. And then, adding money makes sense, since you are long-term bullish anyway.

Let’s crunch the numbers.

The two tables below show the net worth of an investor who bought a stash of 5, 10 or 50 BTC at 20k or lower. 20k USD would be the standard bottom of the bear cycle in 2022. 90k USD is a reasonable target for the next bull cycle, I’m adding 135k for a more optimistic take as well.

Long-Term HODL, No DCA

In this section, we’re mapping how the value of the stash rises when BTC appreciates.

| [realistic] Long-Term Stash, No DCA | |||

|---|---|---|---|

| BTCUSD Appreciation | From 20 000 USD to 90 000 USD | ||

| Stash | 5 | 10 | 50 |

| - Start Value | 100 000 USD | 200 000 USD | 1 000 000 USD |

| - End Value | 450 000 USD | 900 000 USD | 4 500 000 USD |

| [optimistic] Long-Term Stash, No DCA | |||

|---|---|---|---|

| BTCUSD Appreciation | From 20 000 USD to 135 000 USD | ||

| Stash | 5 | 10 | 50 |

| - Start Value | 100 000 USD | 200 000 USD | 1 000 000 USD |

| - End Value | 675 000 USD | 1 350 000 USD | 6 750 000 USD |

If you start with a stash of 5 BTC, your best chance in the optimistic scenario is not even hitting a million. That is, ever. You could wait until next year or you could wait for 30 years.

Now let’s throw monthly DCA into the mix.

One Decade of DCA

To compare the profits from buy and hold strategy with profits from dollar cost averaging, we need to have a model for future prices of crypto.

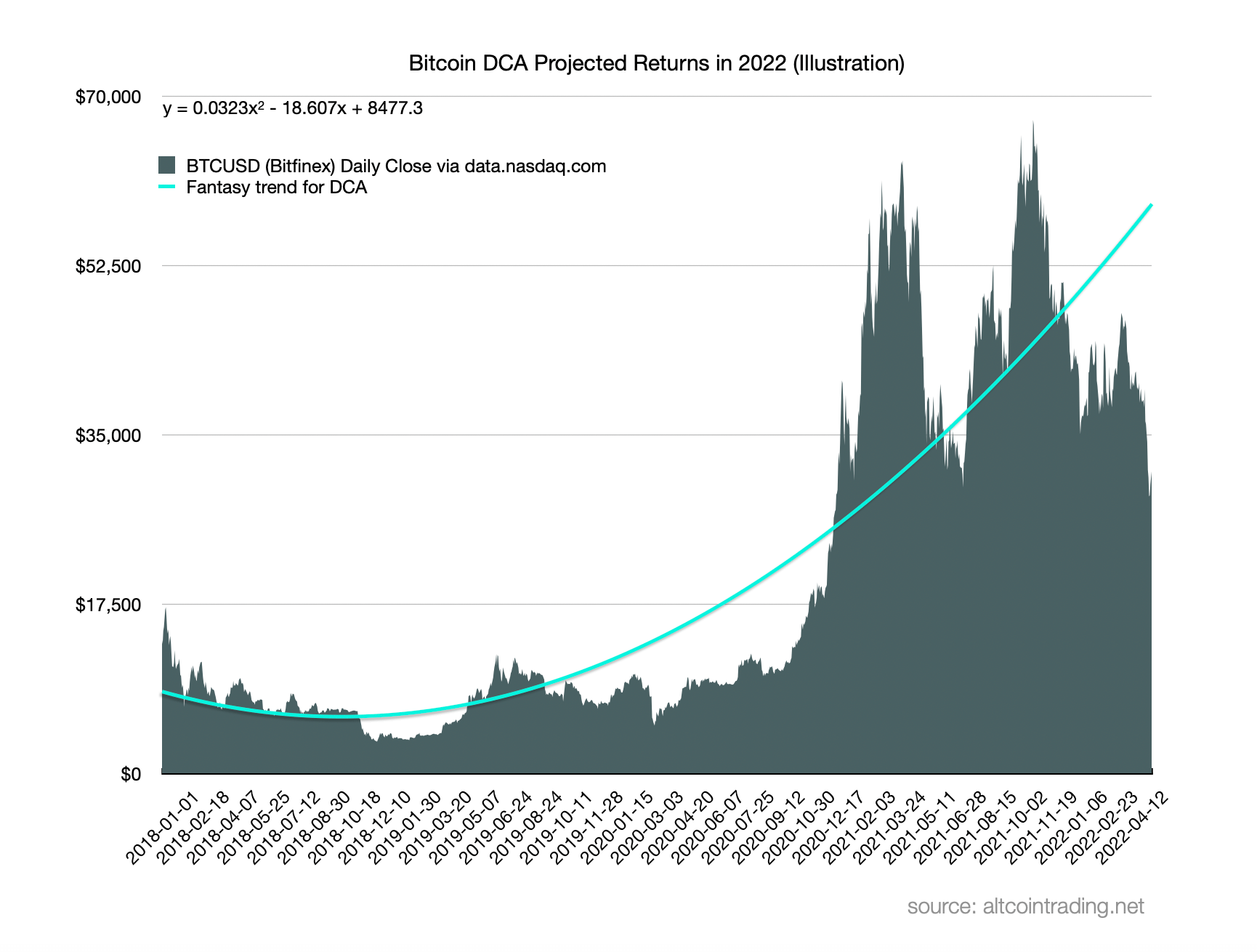

I am using a fantasy bullish parabola that I got as the polynomial trend line for BTCUSD daily data from the start of 2018 until May 2022.

For an illustration of realistic DCA profitability, I modified the parabola that you see on the chart above.

- It’s 2022 and crypto is trending down, so I shifted the DCA starting point to around 20k USD.

- I kept the parabolic growth as shown, except every 30th month I crashed it down to about 45k USD.

This is not an unrealistic model - thus far, parabolic rises and prompt crashes have been the mainstay in crypto. Also, starting from 20k and having a deep crash every 30 months puts the final price after 10 years to about 135k USD. This would be more or less consistent with the history of the BTCUSD market, with projections based on technical analysis and with what the community considers achievable.

I used this combination of parabolic growth and crash to work out how much bitcoin you will be able to afford each month for the same amount of fiat.

Turns out that idle hodling means much lower profit for what already is a long-term bullish bias. Things get even juicier on a higher disposable income, as they usually do: At the DCA of 2500 USD monthly the projections for 10 years nearly doubles your final net worth when compared to buy and hold.

| Monthly Bitcoin DCA: 10 years, from 20k to 135k | |||

|---|---|---|---|

| Disposable monthly income | 1 000 USD | 2 000 USD | 2 500 USD |

| Initial “Buy & Hold” purchase | 5 BTC | 5 BTC | 5 BTC |

| Starting value at 20k | 100 000 USD | 100 000 USD | 100 000 USD |

| Value without DCA at 135k | 675 000 USD | 675 000 USD | 675 000 USD |

| Number of DCA purchases | 120 | 120 | 120 |

| BTC added over 10 years | 1.88 BTC | 3.77 BTC | 4.71 BTC |

| DCA contribution at 135k | 226 049 USD | 452 400 USD | 565 122 USD |

| Total Final Net Worth | 901 049 USD | 1 127 400 USD | 1 240 122 USD |

Formula: 0.0323*x*x-18.607*x+8477.3 (x=count of days) Crash every 30th month to 45k

Best Exchanges to DCA into Crypto

The point of DCA strategy is to stick to your long-term bias, come what may. Unless you are extremely disciplined, it will be best done automated.

The most cost-effective way is to automate your DCA right on the exchange, leaving out any third parties. Other than that you just need an exchange with stable banking setup and well worked-out KYC/AML onboarding, because you are DCA-ing from fiat into crypto.

As of now, Kraken, FTX and Independent Reserve fulfil these conditions. (Technically, Coinbase does too, but their fees are shocking.)

- FTX comes out as the best exchange for DCA in crypto. Their fees are the lowest, there are no legal or regulatory threats and you can automate your DCA right on the platform.

Auto-DCA Bots and Templates

Exchanges with built-in DCA bots:

- FTX - Best overall, but kinda high tech

- Independent Reserve - Only available for AUD

- Pionex - New platform, plus you’ll need to use stablecoins

Standalone DCA bots:

FTX Quant Zone Auto-DCA Template

FTX is a crypto exchange that, like Binance, wants US traders to use a separate platform. The US platform does not provide the auto-DCA tool, you will have to use Coinrule to DCA on FTX.us. With FTX’s fees, the combo of FTX and Coinrule is still the best choice for US-based traders.

The international branch of the exchange lets you automate your trading with an tool called FTX Quant Zone, which to be fair is not built for beginners. If you are not keen on writing your DCA rules in pseudo code, skip further down to third party DCA bots.

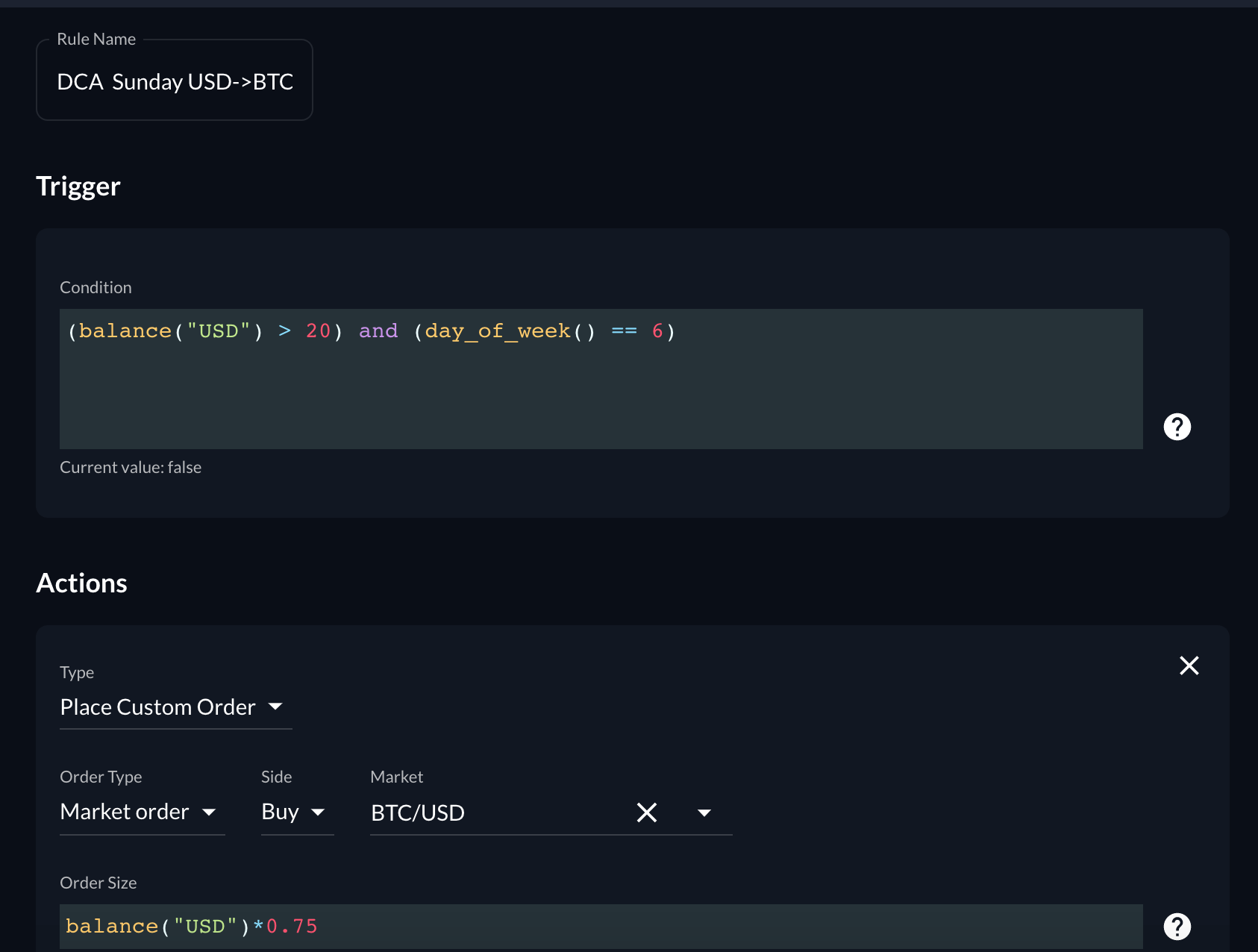

For the rest of you, a weekly auto-DCA template for FTX below.

Sign up at FTX.com with 5% fee off

How to set up WEEKLY automated DCA with FTX:

-

Navigate to FTX Quant Zone

At FTX.com, click the four squares in top left.

From the menu there, click at FTX Quant Zone.

-

Click: Create New Rule

This will take you to the Quant Zone interface with two boxes: The trigger and the action.

-

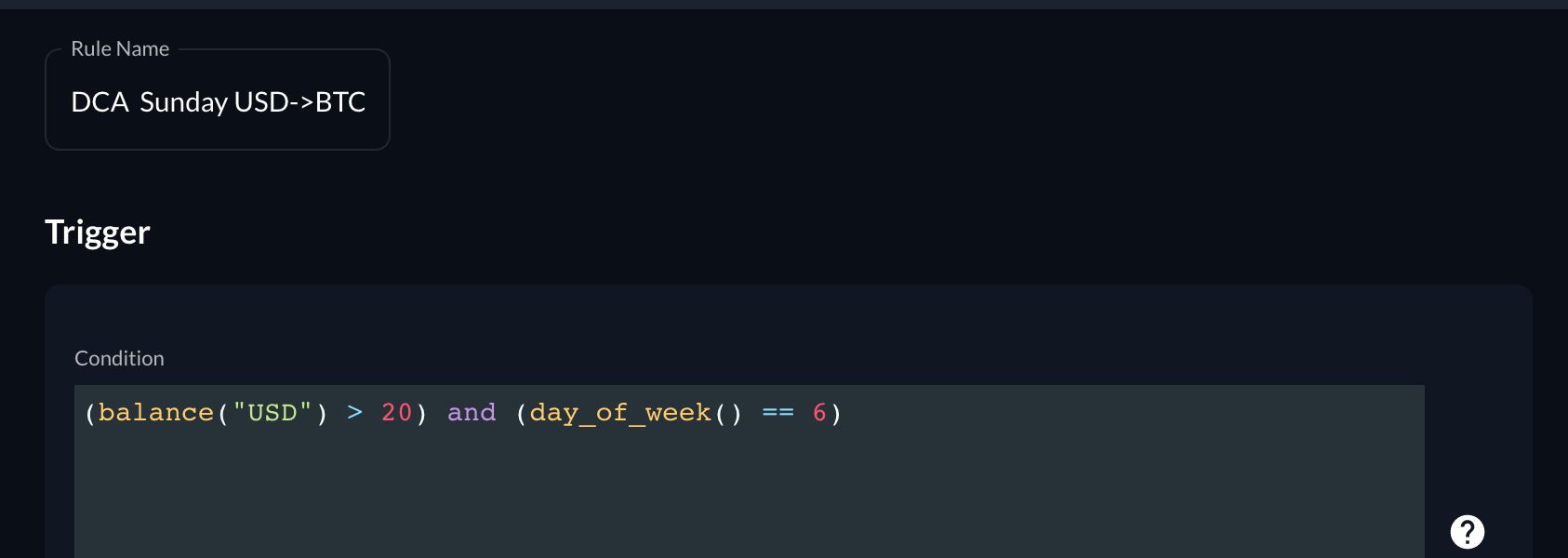

Set up your DCA trigger

This is the trigger rule to buy a cryptocurrency from USD balance every Sunday (day 6):

(balance("USD") > 20) and (day_of_week() == 6)The first part of the rule checks if you have enough balance to pass the minimum order size. The second part makes sure you will buy every Sunday.

-

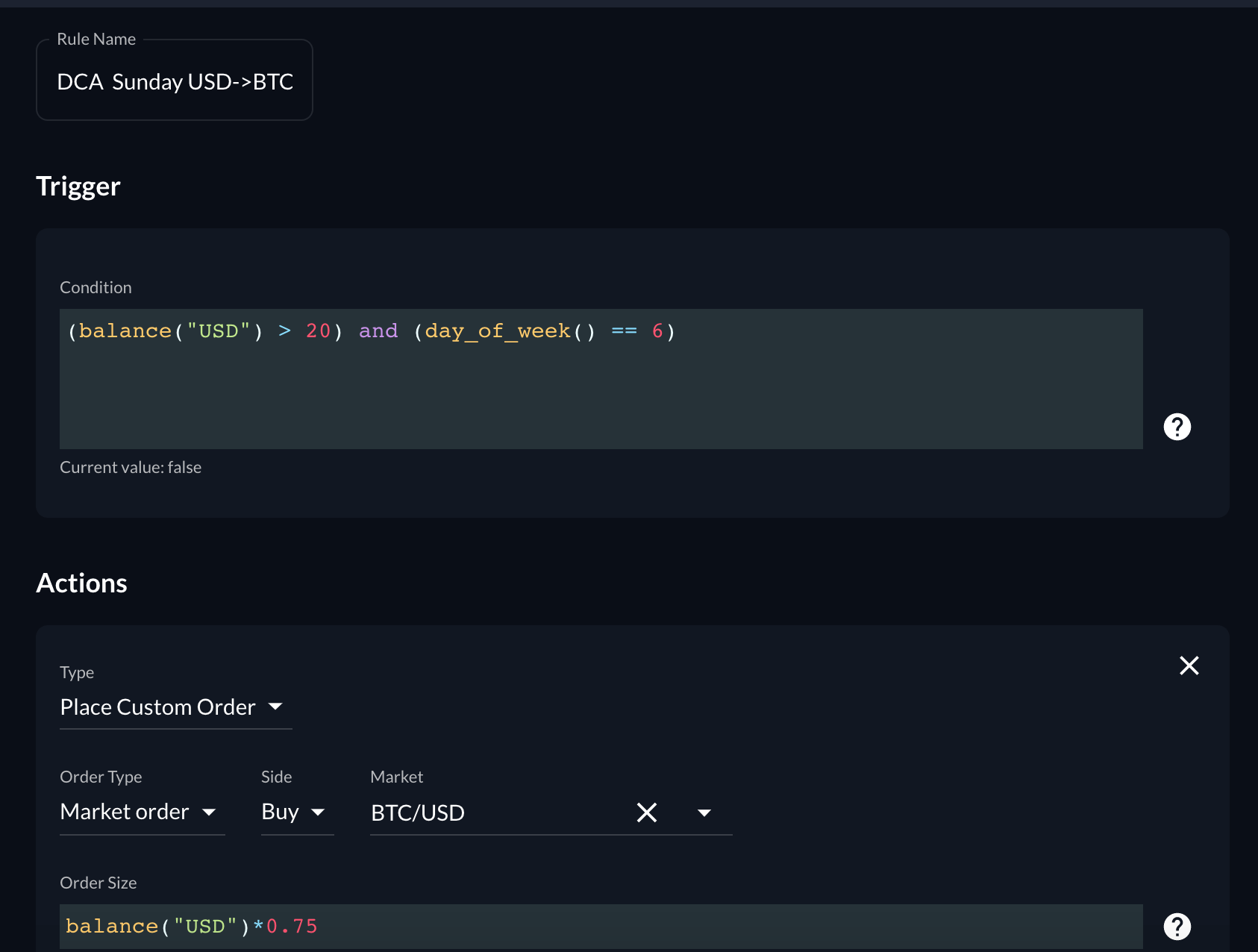

Set up your DCA action

In the action box, select “Place Custom Order”, and “Market Order”.

Also choose the spot market of the crypto you want to DCA in:

BTC/USD,ETH/USD…

-

Set your DCA order size

Set your order size as a portion of your wallet balance rather than as a number.

Example:

balance("USD")*0.75. This will market buy your crypto for 3/4 of your USD balance. -

Click ‘Save and Run’

Here’s the full template once again.

Sign up at FTX.com with 5% fee off

Auto-DCA from AUD to crypto on Independent Reserve

Independent Reserve is an Australian crypto exchange operating since 2013. They accept traders from most parts of the world. It’s a smaller place with responsive support. Onboarding is individual and OTC available.

The disadvantage of DCAing at Independent Reserve are high fees and limited amount of markets (full list here).

The auto-DCA feature is only available for AUD. Independent Reserve lets you set up auto-DCA or a basket purchase from AUD via it’s tool called Auto Trader.

Sign up at Independent Reserve

How to set up automated DCA from AUD with Independent Reserve:

-

Navigate to ‘Accounts’ > ‘Auto Trader’

The Auto Trader is accessible from the top nav. You need to be logged in.

-

Click the button ‘Create New Strategy’

The dialog gives you three options, all of them can be used to DCA.

Most traders will need the 3rd choice - AutoSchedule. This will buy a single cryptocurrency in regular interval with AUD balance, as long as there is any.

If you want to DCA into a basket of cryptos, go for the 2nd option (AutoBasket). It will split your fiat among several coins, otherwise it’s the same.

-

Choose a side

For DCA you are going to choose the buy side, but the bot can also be set up to sell your crypto.

-

Choose a cryptocurrency to DCA into

Independent Reserve supports all dinosaur cryptocurrencies and some DeFi tokens. And, indeed, weighted baskets.

-

Choose the frequency of your transactions

Daily, weekly, fortnightly, monthly, or last day of each month.

-

Select your transaction size

Either a fixed fiat value, or percentage of your account balance each time the strategy executes.

Sign up at Independent Reserve

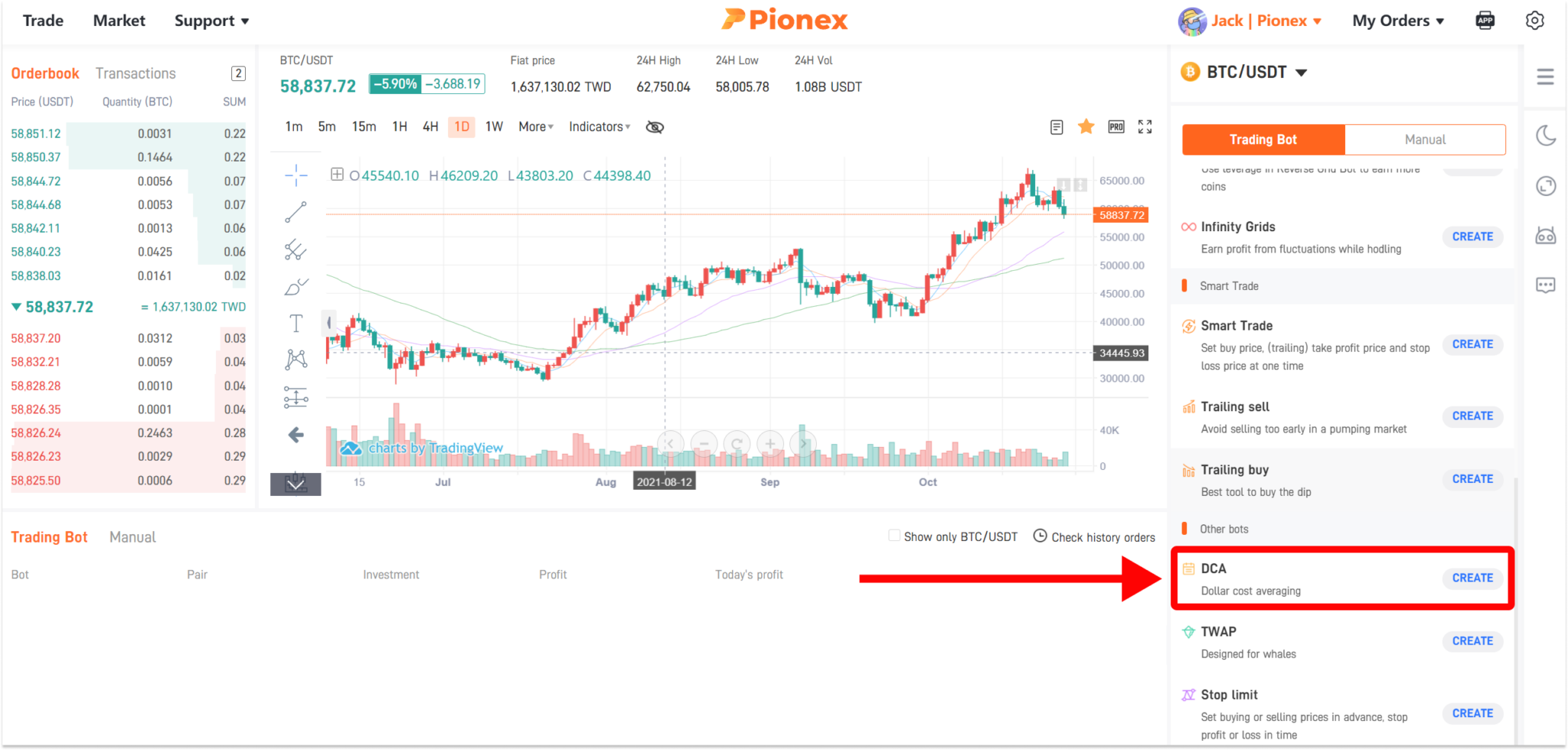

Pionex auto-DCA bot

Pionex is a new Asian exchange that has more than 15 different crypto trading bots available right on the exchange. One of them is the DCA bot that will automate the whole process for you.

The image below shows what the DCA setup looks like - you just need to deposit and click a button.

The drawbacks of DCAing via Pionex is that the exchange is fairly new, and that you will need to use the Tether stablecoin to DCA via Pionex.

Disregarding any systemic uncertainties with regards to stablecoins - To buy USDT for fiat you will need to get KYC verified on exchanges like FTX or Bitfinex anyway. Moving money between exchanges creates an additional step that you might find inconvenient.

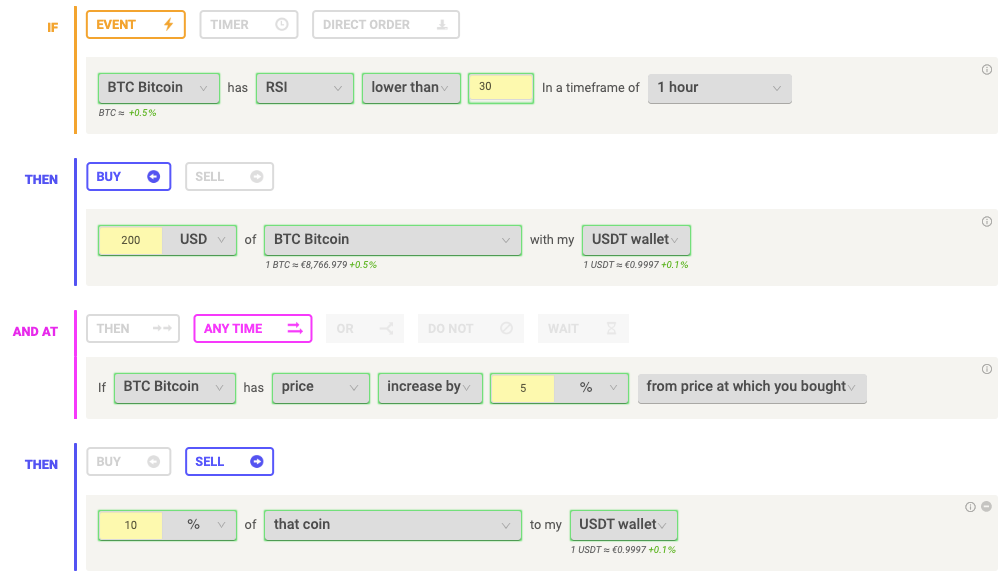

Coinrule Auto-DCA Template

Coinrule is a no-coding bot platform that integrates with most popular exchanges. The user interface is fairly easy to understand, it’s all buttons and checkboxes.

Coinrule supports all major exchanges and you can use it to auto-DCA on Kraken, Binance, Coinbase or FTX.us. You probably need to use Coinrule if you are based in the USA.

The disadvantage of Coinrule is that it’s a paid platform, and that it is a middleman.

Here’s what the Coinrule DCA template looks like, with additional technical analysis conditions:

Coinrule encourages to add conditions based off technical analysis to your DCA template. For instance, you can set your Coinrule DCA template to only execute if RSI is low.

It sounds like a good idea as it can weed out your “bad” DCA purchases during tops. On the other hand, over a long stretch of time you may end up gaining less exposure if you set these conditions. This is not very consistent with the idea of DCA.

Bitsgap DCA bot

Bitsgap is a new bot trading platform based in Estonia.

Much like Coinrule, they offer an easy-to-use app, support additional parameters from technical analysis and work with most of the popular crypto trading platforms. Bitsgap lets you DCA on Coinbase, Kraken, Binance, Bitfinex, OKX and other exchanges.

As of May 2022, modified DCA bot strategies with MACD and Stoch RSI are in the making, but a grid-like bot is already live.

Again, introducing technical analysis into DCA sounds like a good idea but over time, you may end up gaining less exposure if you set TA conditions. This is not usually the goal in DCA.

Checklist: How to set up DCA into crypto

This is a step by step list of tasks to do to set up DCA or auto-DCA on any exchange. Detailed automation setups by platforms are below.

- Do your KYC/AML on your exchange.

- Set up a monthly transaction from your bank to the exchange (such as on the day after you get paid).

- Automate your DCA buys - directly on your exchange or via a middleman.

- Independent Reserve has a feature called Auto Trader. Set it up to buy a cryptocurrency for a set percentage of your AUD balance once a time period.

- FTX has an interface called Quant Zone that lets you program trades based on any criteria.

- Coinrule is a bot platform that lets you set up auto-DCA on big exchanges like Kraken or Binance.

- As long as you have fiat balance at the exchange, your auto-DCA trigger will be executed as set up.

- On days when there is no deposit in your exchange wallet, auto-DCA will not execute.

Benefits of DCA for crypto traders

- In ranging or slumping markets with low volumes, the predictive powers of technical analysis decrease as well. The stop hunts and wicks become more prominent, the conditions are simply not good to trade on TA.

- You avoid babysitting the charts for very small (if any) profits and getting burned out before the macro trend shifts to a more profit-generating action.

- If you are long term bullish in a bear market, with DCA you have the lowest risk of battered bull syndrome.

- It’s impossible to overtrade when doing DCA.

- You can use DCA as the buy or sell method of choice to diversify your crypto portfolio or to implement risk budgeting

Related lists of tools, guides and strategies

- [101] How to do portfolio diversification in crypto (fundamentals, valuation)

- Market psychology of reversals

- Best wallets for staking (& apps, exchanges, platforms)