Products of 2019

2019: Preferred Crypto Trading Platforms

The biggest change from the 2018 meta post is probably the cool-off of BitMEX affiliate earnings.

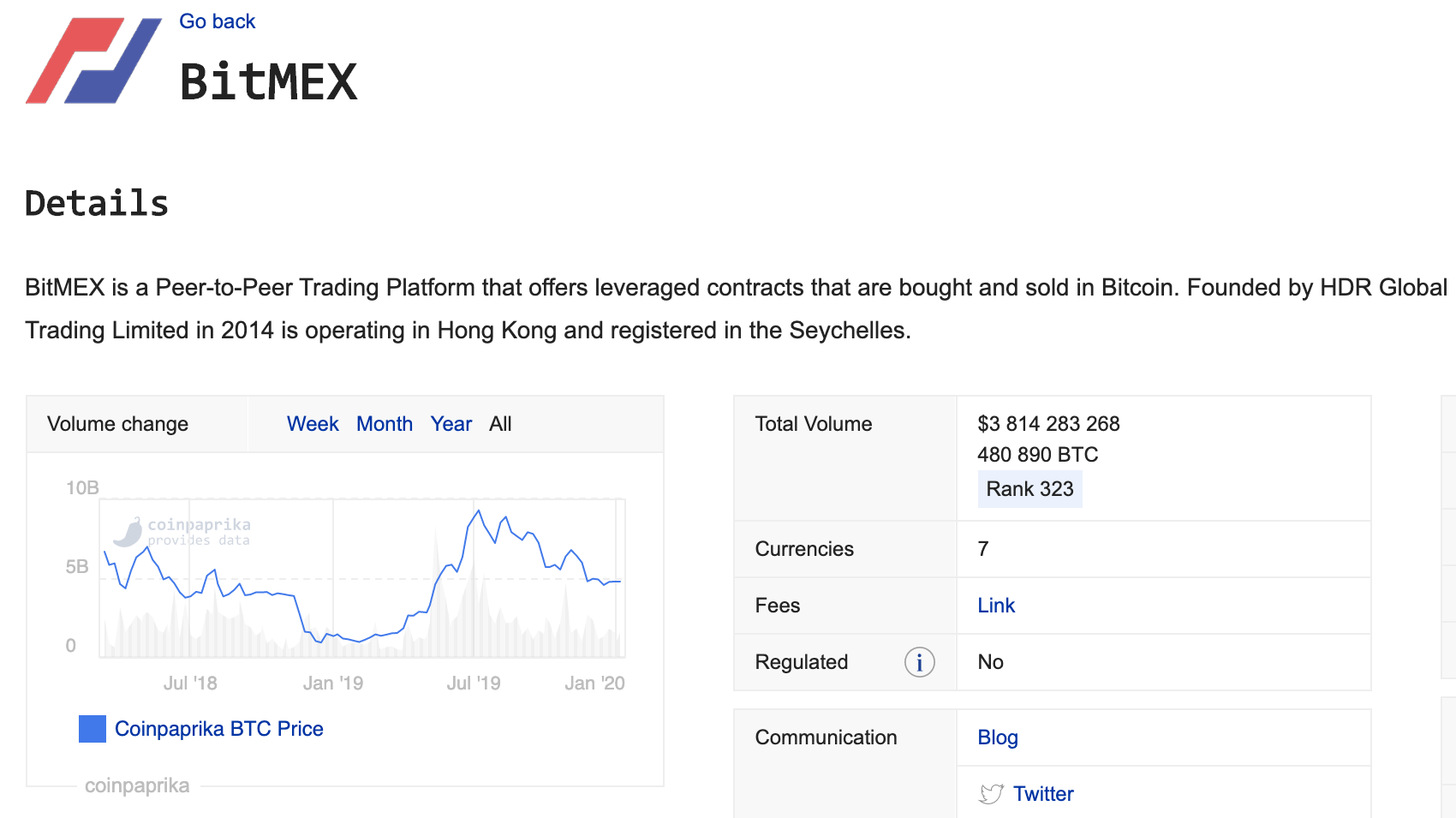

This comes quite as a surprise: The overall volume traded on BitMEX pretty much follows the price of Bitcoin.

There were no crazy bubbles in either 2018 or 2019, but BitMEX did make a decent volume in the summer of 2019. Could it be that gamblers with 300 USD worth of LTH stash perhaps got convinced they are only winning at life if they capitalize on every 5% uptick of the BTCUSD market?

Either way - the readers of this blog did not fancy BitMEX as much in 2019 as they did in 2018.

https://coinpaprika.com/exchanges/bitmex/

As for crypto trading in general, that didn’t go anywhere though.

There was a new wave of influx to Bitfinex once again. It is incredible considering their notorious banking issues, but the commission patterns suggest that people do DCA through there.

Additionally, since the new affiliate platform on Bitfinex pays you out in the currency spent by the referred user, let me tell you that the activity has been predominantly fiat getting spent and shitcoins getting flipped. There has been next to no selling of top-tier cryptocurrencies from the readers of this blog.

- More about Bitfinex: the people, the apps and the 6% fee discount referral code here … or use our super customized shill link bit.ly/catch-me-if-ya-can

2019 New crypto trading apps

Near the end of the year there have been several new products added and while it will be for the next year to see how they do, there has been some interest into the 3commas DCA bot.

2019 Preferred Crypto Wallets and Asset Management

It is no surprise that one of the biggest product hits of the year 2019 was Ledger Nano X.

A new product which was on top of the natural tech hype offered in bulk packs on discount.

From competing products, Keepkey is pretty much forgotten and Trezor still has some user base. Nevertheless Ledger is still by far the winner here.

Hardware seed-phrase storage Billfodl (and Cryptosteel for the EU analog) have been linked from here only for a small part of the year but appear to pass for vanity products rather than something to rely on.

2019 Preferred Crypto Technical Analysis Tools

By far the biggest hit among ATNET readers during all of 2019 were the subscription plans to the charting platform TradingView!

This is something that crypto traders have been signing up for a lot through the whole year.

All in all, the shift from entertainment and high-leverage trading to analysis comes off as a big change in comparison with the past.

One of the reasons of last year’s uptick could be that TradingView started accepting subscription payments in crypto early in 2019.

While for the majority of shoppers in general implementing payments in crypto is in fact an unnecessary gimmick, for us who buy, sell and move cryptocurrencies on the daily it does make things easier. - Certainly easier than trying to log into your Paypal account from a third world country.

From the perspective of the crowd around this blog I think it is safe to say that TradingView PRO is the product of 2019.

Needless to say, the interest in the more advanced platform TensorCharts has been tiny compared to TradingView.

That may be sad for those who want to complain about the decline of our civilization, especially when it comes to intelligence, but then again this is what gives you the edge with products like TensorCharts.

Clearly, the edge is still there even though the product is a couple of years old already.

Let’s see what 2020 brings!