Key Points / DCB

-

Traders call DCB the dead cat bounce

-

DCB is the short-lived recovery that comes after the first bottom in a new downtrend

-

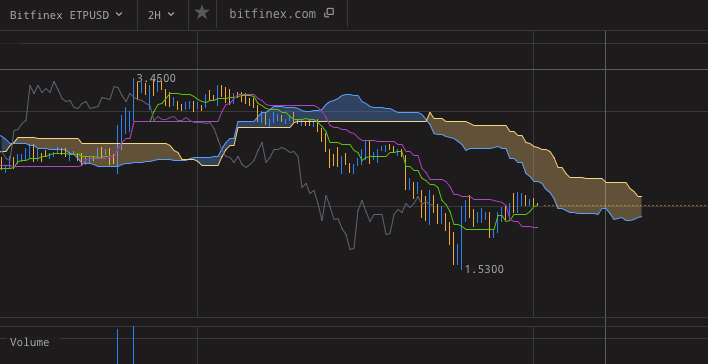

Tools for DCB: #tradingview

In the trading jargon, DCB is short for dead cat bounce. This term is not specific to crypto.

Market traders call DCB the short-lived recovery that comes after the first bottom in a new downtrend.

What is a valid DCB?

DCB is the first bottom after a downturn on the market. Typically, the market will bottom out in two bottoms, sometimes forming a W-pattern.

The dead cat bounce can occur on any timeframe.

It is still a DCB no matter whether the reversal of the direction is only temporary (such as with a retracement) or if the asset continues to makes new lows and goes into a bear market.

How to trade a DCB?

There are several strategies to trade the dead cat bounce. To choose one, consider your risk appetite, your timeframe preference and your long-term position.

- Do you want to do a speculative trade? What’s the expected upside, what’s the expected downside?

- Is this speculation, like scalping, or do you want to protect yourself in case this is the top?

- In the long run, are you bullish or bearish on the asset?

Trading DCB as a speculation

Scalpers and short term traders will watch the 1-5 minute timeframe for turns in volume, hitting a support and sometimes Fib levels.

Longing the first bottom

On first bullish signal, open a leveraged long. Then close it for small profit once the bounce from the bottom starts to slow down.

- Tensorcharts can be very useful for this.

Shorting the market retrace

On the market topping out and starting the market retrace, open a short. Set up either a trailing stop or a regular stop at the top and move the stop down as the price falls.

On good volume, a good place for the stop is the middle of the previous candle.

On thinner and volatile markets with stop hunts, the top of the previous candle is better.

For a fully automated TA-based trading, try the Coinrule bot. The interface is user friendly, no need to write code to create or even backtest your automated trading strategy.

Market Retracement: Trading DCB in case it could be “the top”

If the price retraces from a top, nobody can be certain whether it’s a local top or the end of the bull market. There are always signs, but then again - sometimes honeybadger doesn’t care and the bull market extends further in spite of those signs.

There is a technique of trading the market retracement that can protect you in case the price falls more and for longer.

This technique is less for profit and more for hedge.

- Open a short once you notice the price topping out. BBands patterns help there.

- Set your stop to previous high once the price moves down.

- Wait for the DCB, the rise from it and the top of the first bounce.

- Once the price moves down for there, set your stop to the top of the first bounce.

In case the market makes new highs, your stop will trigger and you’ll be back in. In case the market falls further, you have a short.

Best Tools for Trading DCB

- Trading Platform: Bitfinex

- Technical Analysis: Suport/Resistance, RSI, BBands

- Charting App: TradingView