In this article:

- The safest crypto arbitrage is the two-country model

- Arbitrage on big crypto markets is not worth it

- Two crypto arbitrage types profitable in 2022

- Small altcoin arbitrage: Why it works, Tools, Best Arb Bots

- Spot-futures arbitrage: Why it works, Tools, Best Arb Bots

Crypto arbitrage bots seem to be the crypto trading flavour of the week.

For better or worse, arbitrage trading (crypto or other) stops working when everyone starts doing it because the market prices on a free market change with trading activity.

Two-country Setup is Forever The Best Crypto Arbitrage

One of the implications of that is for instance that the safest crypto arbitrage will always be the two-country set up: Countries like South Korea or Japan live a bit secluded from the US & EU trading, and so the fiat value of crypto markets tends to trail farther off the US & EU dominated international markets.

In South Korean markets, restrictive capital policies have made the markets especially prone to price discrepancies. In the press you will often see this referred to as the “Kimchi premium”.

Why is the two-country arbitrage the safest? Because it’s so hard to get into.

You need to have some sort of presence in two countries - such as, being native to EU but a permanent resident to South Korea for instance. Otherwise Korean exchanges won’t let you open an account or won’t let you withdraw fiat money.

That means that the vast majority of people who notice this arbitrage opportunity will not be able to trade on it. That in turn means the markets will not manage to close the price gap, because there’s not enough people trading that gap.

Crypto arbitrage on big international markets is not worth it

The two-country set up is not the only type of arbitrage that’s out there.

Plain arbitrage would have you trade the same market on two different exchanges.

Then you can also do triangular arbitrage, which is where you take advantage of three different currencies - such as BTC/USDT on Binance, ETH/BTC on Kraken and BTC/ETH on Bitfinex.

- Example triangular arbitrage: With Bitfinex you’re able to trade BTC for ETH, on Kraken you can trade ETH for USDT and then finally on Binance you can trade USDT for BTC. If the price of each currency moves just right, you can end up making a small profit from the entire transaction.

But both plain and triangular arbitrage are reasonably considered more risky than the two-country arbitrage, because you’re dealing with currencies on internationally open markets.

Internationally open markets get traded (by people and bots) in large volumes, which quickly erases arbitrage opportunities on most big markets like BTCUSD or ETHUSD.

With the price gap that gets smaller and smaller with time, you need to be able to move more and more money to get a fee discount for volume and a decent profit in.

And then, since this is crypto, consider that unregulated custodial exchanges themselves may run arbitrage bots and trade with customer deposits. In legacy markets this would not fly but in crypto there is nothing preventing that.

How to choose a crypto arbitrage bot that will still earn in 2022

The only avenue where crypto arbitrage bots can still earn you good money is in small altcoins, and in spot-futures arbitrage - either through the so-called “cash&carry” arbitrage, which pays out when the futures contract expires, or through arbitrage of a crypto perpetual swap, which pays out several times a day when the funding rate changes.

Let’s now quickly explain why these two arbs work, and add a list of the best crypto arbitrage bots and other useful arbitrage trading tools for both small altcoin arbitrage traders and for spot-futures arbitrage traders.

-

Small altcoin arbitrage (Coinigy , Trade The Chain , Coinrule )

Why is this arbitrage consistently profitable: Newly launched crypto markets are always prone to insane price fluctuations in their early price action, and those insanities are not necessarily in sync across different exchanges. This gives the opportunity for arbitrage: You can trade the price difference of the same alt coin as it launches trading on several exchanges.

How to choose the arb bot: Since the arbitrage gap is relatively short-lived, you do actually need a crypto bot to notify you on the opportunity. You would not manage finding the opportunity manually and executing it in time.

If you want to arb small altcoins, look for an arbitrage bot trained for looking up anomalies on small altcoin markets specifically.

Best Tools for arbing small altcoins manually

- (freemium) Coinigy is a freemium crypto charting platform that lets you trade directly through the interface. That makes for a fast enough acting to arbitrage small altcoins manually. Additionally, Coinigy provides the ArbMatrix which is an alert system that notifies Coinigy users on arbitrage opportunities.

- (paid) Trade The Chain is a dashboard and an AI market signal tracker that will alert you on any new market launches and any abnormal activity on markets. Those are the events you want to act on in arbitrage trading - that is where most of the profit is these days.

Best Crypto bots to help you execute arbitrage

- Coinrule Bot - Coinrule has an automated crypto arbitrage bot, but it uses BitMEX exclusively. On other exchanges you won’t get the automated system that looks for opportunities for you, although Coinrule promises more features are coming.

- 3commas Bot does not provide a built-in automation for crypto arbitrage, but the link goes to a really in-depth guide into arbitrage trading that they have in their blog.

-

Spot-Futures arbitrage (Pionex )

Why is this arbitrage consistently profitable: Futures markets offer cheaper leverage than margin trading on spot markets. It is not immediately obvious, but that is basically the reason why futures markets usually have an arbitrage opportunity, even though they are not new markets and they are available internationally without restrictions.

Cheap leverage means that futures get speculated on by greedy traders who look for future moon, and this particular trading activity often drags the future price above spot. Conversely, in times of fear, traders (but also miners or hodlers) use futures to hedge - by selling. This often drags the price down below spot.

The eternal cycle of fear and greed on free markets explains how there almost always is some arbitrage opportunity in crypto futures.

How to choose the arb bot: The crypto spot-futures arbitrage opportunity is good enough to execute the arb manually, because with spot-futures arbitrage you only get paid the day the futures funding rate changes. So, there is no need for trading at scale or acting super fast.

The drawback is you need to be actually trading full time to notice spot-futures arbitrage opportunities.

If you’re not a trader but you want to trade spot-futures arbitrage, get a bot. Look specifically for a crypto bot trained for spot-futures arbitrage. The bot will seek the opportunities for you.

Best Arbitrage Bots for Perps Funding

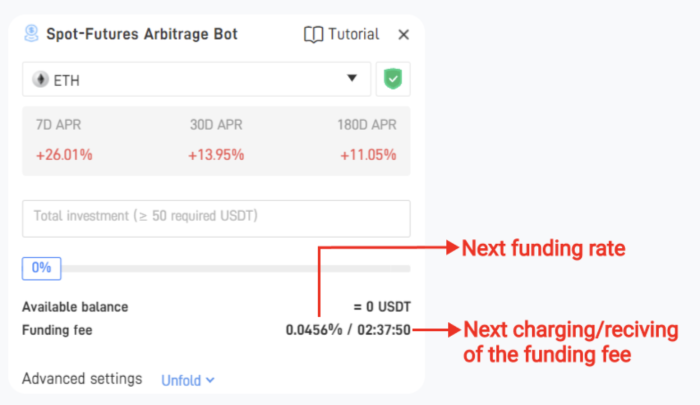

- (free) Pionex Arbitrage Bot - Pionex is a new Asian exchange that has more than 10 different crypto trading bots available right on the exchange. One of them is the spot-futures arbitrage bot that will automate the whole perpetual futures arbitrage process for you. The image below shows what it looks like - you just need to deposit and click a button.

Bottom line

TL;DR: unless you are a high frequency trader with access to proprietary software, you will not find many arbitrage opportunities in big crypto markets worth your time. If you still want to do it, niche down and look for a bot that’s been trained specifically for the task.

Your best crypto arbitrage opportunities right now are arbing very small altcoins and arbing the perpetual swap funding rate. The perps arb can be automated.