Financial crimes are on the rise everywhere in the world.

Money laundering is a persistent problem in all financial sectors. Billions of dollars are lost every year to money laundering crimes.

In 2020,2,300 criminals were arrested for money laundering within the United States alone. It goes on to show how pervasive the issue is. But as financial crimes are on the rise, organizations are keeping up with effective Anti-Money Laundering solutions.

A special set of software works exclusively to protect organizations and companies from money laundering. They are known as AML or Anti-Money Laundering software.

At the same time, AML regulations can be a bottleneck in user on-boarding to the point that good AML solution can give a company a real competitive advantage.

- Onboarding at Coinbase is completely painless, because they probably use a software solution with behavioural analytics.

- Contrary to that, when onboarding to CEX.io you are required to fill out a 22-page Typeform and wait for manual evaluation.

What does AML software do?

From the practical point of view, AML solutions serve the function of ensuring compliance with AML laws and regulations.

Technically speaking, anti-money laundering software solutions work by surveying huge datasets and identifying suspicious patterns.

AML software is a complete solution for detection and evaluation of these patterns. By doing that, it protects organizations from unwillingly serving money launderers.

Anti-money laundering solutions work in different ways. All the different functional components work together to provide all-around security for any organization. From protecting you against criminals to making sure you are not breaching laws, AML solutions do it all.

While machine learning facilitates the pattern identifying features of AML solutions, other features primarily work to monitor customers and transactions. They also assess risk and ensure compliance with regulations.

Top 5 Top Anti-Money Laundering (AML) Solutions

AML solutions are a necessity for any firm dealing with money or sensitive information.

The cryptocurrency industry was an exception to the rule when it was in its infancy, but those days are long gone. AML/KYC is required on most trading platforms and in many cases, it may be more difficult to take your cold storage profits if those cryptocoins have a bad history and you cannot prove you only bought them afterwards.

Let's explore the five top anti-money laundering solutions that ensure complete security and maintain compliance terms.

-

Leading banks and businesses around the world trust Oracle for their AML solutions, and the blockchain industry will probably move in the same direction. Oracle Anti-money laundering solution is a complete set of features for top-notch security.

Oracle AML solutions are active in over 140 countries. That directly translates to a huge database of users, which means better data to work out fraud patterns.

It also helps in compliance with CDD and KYC regulations. When dealing with potential money launderers, Oracle automatically scans their credentials with global watchlists.

Prebuilt regulatory analytics make sure that you are never breaching AML regulations. Once you start using Oracle AML solutions, you need not worry about the technical complications and nuances of AML regulatory statutes. It is a complete solution for comprehensive protection against money laundering.

Deutsche Bank, HDFC Bank, and CaixaBank are some prominent users of Oracle AML solutions. They manage and bill a total of $200 billion.

-

Refinitiv World-Check Risk Intelligence is a part of Refinitiv Financial Solutions.

Founded in 2018, the company has gained a good reputation in a short time. Its breakthrough product in the AML field is the World-Check Risk Intelligence. It takes care of all your compliance policies, protects you from criminals, and warns you of threats.

Refinitiv takes pride in its research methodology, claiming to bring only reliable intelligence to you. Their evaluation criteria are strict to minimize chances of slip-ups.

Some of the Refinitiv analysts are former employees of central and federal governments, which is a good guarantee of quality. They know and in and out of AML policies and threats, do a great job of offering protection.

Data from the World-Check Risk Intelligence report can be integrated into third-party platforms, such as cryptocurrency exchanges.

Being the smaller player, Refinitiv is winning through interoperability and productivity.

-

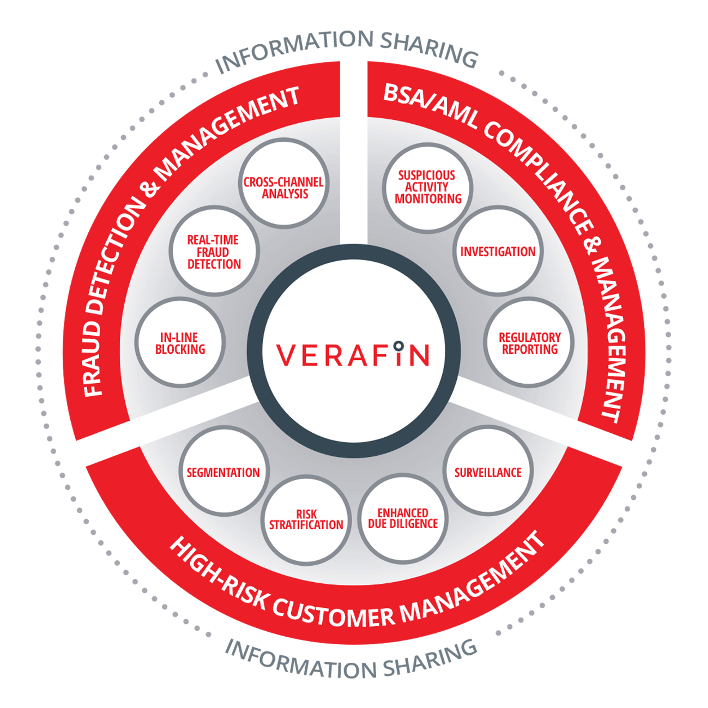

Verafin offers a cloud-based cross-platform AML solution that more than 3000 companies use to protect against money laundering. You get all standard AML solutions like high-risk customer management, fraud detection, AML compliance, and information sharing. With Verafin, you can keep things simple while ensuring robust security.

The biggest challenge to detecting financial criminals is their use of multiple platforms. No money-launderer would give away their location foolishly. However, with Verafin you can be sure of outsmarting criminals.

Verafin uses machine learning and collaborative investigation to alert you of all potential threats. You get a comprehensive solution encompassing detection, investigation, and reporting.

Verafin also comes with a very useful feature that keeps companies updated about the latest trends on financial crimes. They use information from their large datasets and combine it with customer feedback to detect threats and identify patterns.

-

SEON is another complete anti-money laundering software solution that protects your enterprise from every aspect of money laundering.

SEON is popular especially in the gaming industry. Their software beats other solutions with its accurate behavioral analytics and real-time alerts - both are important aspects of the entertainment business.

SEON offers the best services with respect to the KYC processes. With extensive support for the entire process, SEON makes sure all your KYC requirements are fulfilled. It has a smart real-time identity verification system that makes its KYC solutions so effective.

Another reason why gaming (and other) startups choose SEON in particular is the transparent pricing and hassle-free set up it provides.

-

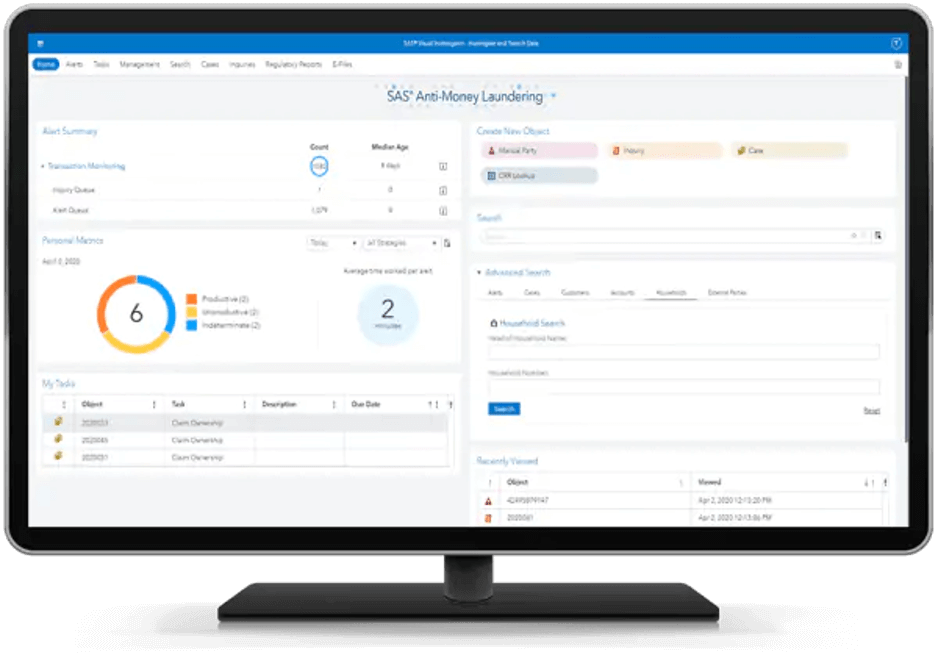

Our last entry on the list is SAS Anti-money Laundering services.

SAS implemented artificial intelligence and machine learning to detect behavioural patterns and warns you in cases of threat.

The biggest perk of using SAS Anti-money Laundering is its out-of-the-box interface. With this intuitive interface, analysts can work faster and with more ease. On a broad scale, it leads to increased productivity and faster result generation.

With multi-jurisdictional watchlist coverage, customer behaviour monitor and a host of other features, SAS Anti-money Laundering is a complete AML solution for any enterprise.

In conclusion

Every year, 2% to 5% of the global GDP is lost to money laundering activities. For financial firms, industry leaders, and last but not least the governments, this is a primary cause of concern.

In 2025, AML solutions are non-negotiable for almost all types of cryptocurrency businesses.