In a recent short note on news.bitcoin.com an interesting information appeared - 46% of ICOs from 2017 already failed. There surely are scams and failures but one way to work with token markets is to take the past failure data and draw valuable information from them.

Look at ICOs from 2017 that failed

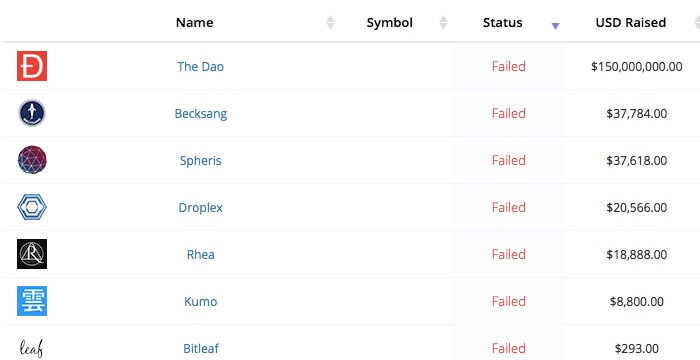

The information about failed ICOs is easily accessible. Simply go to tokendata.io and list out all ICOs, current and past. When you then filter the results by status you can get the projects with status of Failed to the top. Brace yourself, there is a lot of them.

Now, there is a way to interpret the information though.

You see that the first failure right on the top of the list is The Dao. You probably know The Dao had a buggy code which was only discovered once a hacker started draining it. Since then it seems the crypto audience has this kind of PTSD - very little trust in anything called Dao.

Which is a shame because there are Dao’s such as the MakerDAO that are working on projects that could be very useful for crypto trading: a crypto loan backed stablecoin - fully on blockchain yet still worth 1 USD; that is a token system that doesn’t need to hold fiat collateral in a bank as Tether and when backed by big coins also a token that is less vulnerable to market manipulation than NuBits or other stablecoins that maintain their peg only by manipulating supply/demand.

The Dai is not perfect, it does fluctuate while it converges, it is an experiment - but in the case of stablecoins it is an experiment working towards something that would be very useful on the cryptocurrency markets, no matter what some think. It would make arbitrage possible even on markets where you cannot get fiat out, there would still be the USD value that everyone is used to but this time only as a convention.

Back to the ICO research: the failure of The Dao should not be interpreted as a dead-on-arrival for all future Dao’s. It was a critical failure but it is not like there wouldn’t be a market or an application for some Dao’s. Some will be nonsense for sure but the key point is not to let the fact that it is a Dao cloud your judgement.

The three things to look for among failed ICOs:

- Nonsense projects, joke projects etc - there is the Doge but chances are not many other joke tokens will follow successfully like this. Joke projects are a NO, unless you have some good PnD plan.

- People who were behind proven scams and ponzi schemes. A clear NO.

- Projects that failed and are now being rehashed - look into why it failed, the really bad sign for the idea in general is not a hack but nonexistent market. A failure might have also happened because of poor marketing though, you will need to research and asses properly. Good thing is in 2018 airdrops are the rage a bit more than ICOs, and they are less risky (if you take care of your security) as they don’t require an investment. So for instance there was an ICO for MoonFunding, now labeled failed, a startup marketplace which was not heard of other than at Bitcointalk. Right now we have LEXIT which can be obtained from an airdrop. That is a YES or a NO, depends on the situation.

What to follow closely when you are already in

If you have picked a token, participated in an airdrop or ICO, got the token to your ERC20 or other wallet: Do subscribe to CoinMarketCal or a similar tool that collects news about coins being listed to Kucoin or Binance. Binance in particular is important (it used to be Polo back in the day) because it is the most popular trading platform.

Upon listing there the brand new market usually experiences such an influx of people that the token price typically shoots up right on the launch.

It depends on the particular token but very often this surge is short-lived. To put it in a straightforward way, the initial listing pump is not the time to FOMO and increase your position in the hopes for lambo. On the contrary, the proper liquid market is just being formed, it is a better strategy to set some high sells instead.

Even if you believe in your token, don’t let this philosophy put you off: you can always buy back.