In this Trading Strategy:

- On the 2021 NFT arts market

- On the three reasonable NFT trading strategies

What else we wrote on NFT trading:

- 101 - Basic checklist before you invest in an NFT as a newbie

- 201 - NFT markets, open and closed: Where is the value?

NFT art, the high-tech iteration of Rare Pepe trading of 2016.

You have definitely heard if not about NFTs, then surely about the money some people extract out of that market.

Just by a quick glance at my Twitter feed, I am sure there's plenty folks out there ready to convince me that NFTs are the future of human civilization. And clearly even more of those who care only as far as there's a quick buck to make.

That made me curious. Would I be able to get the account of someone with a more practical point of view at all? Best case, somebody who isn't primarily a crypto enthusiast?

I tapped into my underground connections in second class countries (including France) and searched among people who are not public about their engagement with cryptocurrencies and the related community.

I found plenty. Willing to give anonymous accounts, so this article cannot be taken for more than an anecdote.

Still - if you don't give a flying f about NFTs, like I don't, keep reading. You're in a good position.

NFTs are the new ICOs, art curators are the new shitcoin shills

One of the most detailed accounts I got was from the marketing director of an IT hardware company.

That was also one of the most surprising types of business to get involved in NFTs.

No apparent relation to crypto and no reasonable use case for cryptocurrency tokens or blockchain – well, that aspect is not new. But at the same time we are talking about a long established company that develops privacy-focused hardware used in corporate infrastructures, not some sort of vaporware.

,,It's because our marketing was in shambles for the past 10 years right up until 2020, to be honest," explained the marketing director who only started working with the company in 2019. ,,All our main competitors took contracts with the big telecom providers and grew. So even though we've got better privacy and almost none of our components are sourced in China, we got stuck as the local company that sells tech to Raspberry Pie geeks in the neighborhood. Nobody knows us."

The company stayed afloat for so long only by being on life support by its sister business, in exchange for some control. Out of which is now our hardware company trying to escape. To do that, they need to build up liquidity - in any possible way.

Turns out the CEO did his market research. In private, he made plenty of smaller flips at Opensea in the past months but only recently he celebrated his first big NFT art sale. He had bought the art for 2 ETH and sold for 80. ,,It was a …Rare monkey or something? I'm not sure," the marketer says.

The company commissioned a freelancer who is building NFTs of all of their geekiest products. They have spent almost half a year building an engaged online community of their geeky retail userbase and now their plan is to sell the collectibles to these guys.

As for the NFTs, the marketer is not yet sure what functionalities to build into them. The company is consulting that with an art broker. But all in all, the director says, they are betting on the hype. ,,We just noticed there is a lot of overlap between the crypto community and our retail clients. Or even with our engineering team, to be honest. That means everyone even internally is aboard with the idea, you know how rare that is? We've got to make use of that."

It would have been more to my taste to get the Fight Club's corporate sponsorship, but as the marketer promptly explained, that is extremely hard to achieve without any strings attached.

Nobody in business wants to make a deal where they are pulling the shorter side of the rope.

Therefore, the best solution is doing it like ICOs did it, before they got regulated and problematic: Get the money piece by piece, from your retail spenders.

Some may be in it for profit, but a lot of them will spend out of loyalty, out of boredom or just because someone told them to and it's not that much money anyway. The last one is especially relevant now when you can buy fraction of an NFT art.

The marketer sent me an Instagram reel by the art broker they are hiring for consulting and promo. It's somebody who owns a small, no name gallery in the middle of nowhere and is now branching out to NFT art trading.

In the reel she's explaining that money in NFT art can be lost in copious amounts and crazy fast as well. What is the key to making profit? Buying NFT art connected with famous names, or NFT art recommended by experienced art curators.

I wonder where we've heard that before.

Corporates learned to speak buzz

Contrary to my expectations, once again, the fintech space is not really into all the innovation – at least according to the account I got.

The person I spoke to was carrying one of the fancy startup job titles, which pretty much amounted to a consulting gig with a regular payroll.

He was openly disillusioned that after five years of making empty ICO promises, the fintech industry is still not moving on to actually start doing something. Instead, they now got a fresh thing to make promises about – the NFTs.

,,ICOs, tokenization and blockchain tech were just buzz words to get funding from small-ish businesses in the finance industry. I can only speak in general, but the mental twist that convinced them was that they are small anyway and have little to lose. But if they invest in positioning their company in a nascent innovative industry while that's still easy, they could possibly be the behemoth one day."

Sounds reasonable, on the face of it, but the reality of the actual work was a bit of a bore.

,,It was a lot of money on some pretty vague terms. I mean, I really can't complain. But I just pretty much spent my days scrolling through the same Coindesk articles as any unemployed Redditor."

Cheapskate companies with high ambitions will surely drop some good money on vague terms in the name on NFTs too. Nothing wrong with that, at all.

But who are the creators in the NFT space?

You have heard the names: CryptoPunk, Beeple, Gromes. This is all native, digital-first NFT art though.

If art curators and art brokers from the world of physical art branch out to dealing with NFTs, how about traditional artists? Are they moving on to NFT art or not?

I interviewed a friend who is an artist and and an artists' mentor, known and active in that community. Coincidentally also a crypto investor since pre-Gox, but this facet of his life is less of a public knowledge.

He assured me there is a lot of interest among some artists, but generally the NFT art community is separated from anything legacy.

I wanted to know more about the NFT people. What is the community like? Is it an actual community or just a group of fanbois who congratulate each other on being early? Just what kind of people is it?

Here my artsy friend started dodging the responses right away.

You've got a community like any other community, there's a lot of people who are just trying new things to keep up with the trends, there are the scammers, there are the business men, hard to generalize yada yada.

Clearly I wasn't going to learn much here, so I tried to approach the same question indirectly.

What is the community is looking at for the future? Surely they do not plan to stick with collectibles?

Here he came alive a bit. ,,Collectibles are pretty good in fact. Especially when it's something that's purely digital. Do you know how much are people willing to pay for their own rare NFT that commemorates an event in history that is important to them? I'm talking merch of their favorite football club. You can digitize the moment their favorite football player scored the winning goal in a world cup and make it a limited NFT. There's so much money to make on auctioning historical moments, like you wouldn't believe."

It sounds fair enough, and you've got to make the money somewhere.

But if the value rests on the record of a historical event, or on a name of a club or any other brand, then the NFT space better get some pretty dire intellectual property regulations. How else would you keep your NFTs unique and rare?

With original art, this problem doesn't exist because original artworks are always unique. Wasn't this meant to be the point?

With this my art friend agreed. ,,And you can bet the NFT art trade is going to blow up much more than the trade with physical art. It's the ease of use that does it."

The key point in his expectation rests on the same principle that underpins the OG bitcoin meme about a Swiss bank account in your pocket.

According to him, the purpose of some part of fine art transactions has always been the following thing: You need to transfer 1,500,900 USD to someone, but for some reason you cannot leave a paper trail for that transaction.

Getting that money in cash and stuffing a pizza box with it would be fair enough for the actual delivery of the money, but then again you would need to explain the withdrawal of 1,500,900 USD to your banking institution.

So then, why not buy a piece of art worth 1,500,900 USD and let a skillful art operator take care of the rest? There is a paper trail that is completely legitimate, but as for its true nature, that part is pseudonymous.

“If the art can be digital, making the transaction even smoother and more streamlined, then so much the better,” he explained.

To this I only had one question: In the traditional fine arts, there is an enormous amount of people – artists, businessmen and enthusiasts alike - who take arts and the related art industry dead seriously.

It is either the meaning of their life, or it makes their life suck less. Their sense of personal identity is built around it. They live through it.

You need these people to hold the market together. Only then the means-to-an-end transactions can mix in and do their job.

So, is there this group of genuine people, really deeply dedicated to the cause of NFT art?

My friend hesitates. ,,Not yet," he admits. ,,But it will happen. NFT *is* real art. Like, there is no reason why NFT art should *not* get to the same level as physical art. No reason at all."

There is not. But as some of us know, having good odds is not yet the same as having the win in your pocket.

On the NFT trading strategies

NFT arts are an interesting market. More interesting for short term traders and possibly even more interesting for marketers, agencies and social media influencers.

Marketing & Co

The bagholding risk is higher than with fungible crypto here. If you're stuck with an alt coin through a drawdown, there is usually some chance the project will change leadership or strategy, the market will pick up and you will make it out.

NFTs are minted by few pieces only with nothing to plan for their future other than being sold and bought for art or speculation, so they are closer to crypto binary options in this sense. They can be actually worthless forever.

As a paid shill you carry the best risk/reward ratio – you only receive the money, standing no cash to lose.

Shills only stand to lose their reputation, if at all. Does that still count as speculation?

Anyway, since NFTs are hyped up, you would be stupid not to charge hyped up fees too. The opportunity here is better than in regular social media work.

Short term trading

As a trader, right now there's not much to talk about other than buying as cheap as you can and selling as dear as you'll manage.

You can very safely assume that the point of the majority of the participants is either to sell it again or to keep it for sentimental value. You should work with that rationale.

- Find the floor value of the NFT and buy around it.

- The price of a token goes up on mentions at social media.

- The potential valuation of a token grows with the size of the audience that might like it.

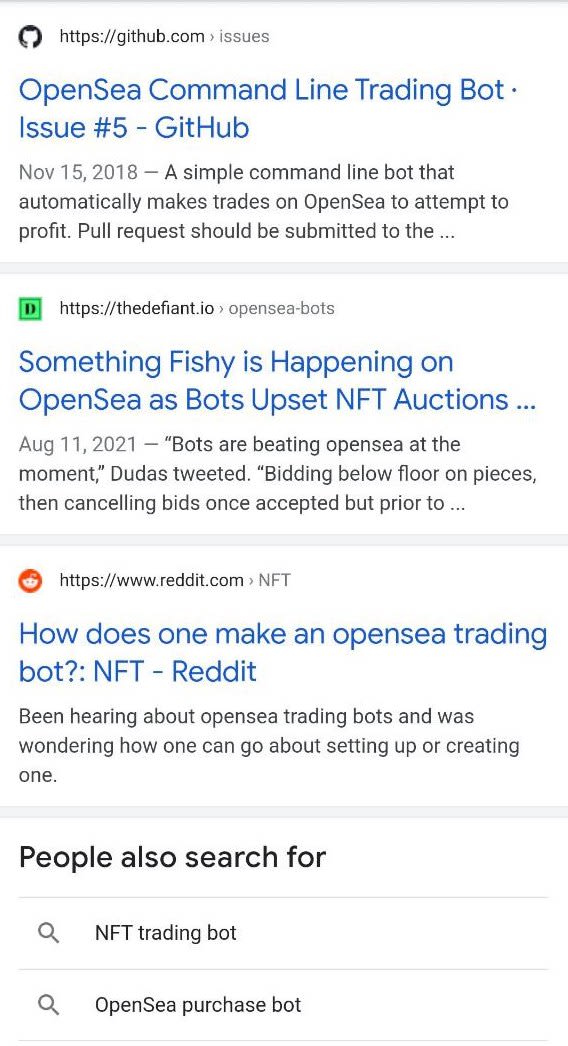

Since this is pretty much a one trick pony market, at least just now, your first thought should be how to automate your flipping workflow.

And you won't be the first one, but you will still be early.

Long term trading

This one is the riskiest at this stage of the NFT market. There is so much NFT art out there, all of it looks pretty much random to the outsider, hard to judge what will people like in the long run when the effect of shilling and hype vanishes.

And then, will the digital art space catch on at all? It may and it may not.

You will either end up with a real valuable collectors' item, or with a worthless piece of code and there is not much about it that you could personally control.

You can do something. Some physical art collectors create unofficial Instagram "fan" accounts for the art they own. They post photos loaded with hashtags to generate exposure for the artist's name. With consistency over a long time this does increase the price of their collection.

But nobody will manage to stay on this unless this is something they really enjoy doing.

If you want to spend your time on this, I guess I'll just say all power to you.

What else we wrote on NFT trading: